Overview:

General Synder flow explained

Synder can supercharge your accounting and make reconciliation easier. Here is an outline of the reconciliation flow for the IntegraPay integration.

Synder normally works with two bank accounts:

- One account is a clearing one, used for recording sales transactions, fees and refunds (so you have correct gross and net income recorded). This account (“IntegraPay Bank Account”) is to be reconciled against the actual IntegraPay, and it will be created automatically once you connect Synder. No bank feeds will be created for the clearing account in Xero. Transactions from there are simply to be marked as “reconciled”.

- The other account is your actual checking account, to which your bank feed is connected. When IntegraPay sends a settlement to your bank, Synder reflects this by making a transfer from the clearing to your Checking account. This account is reconciled against your actual Bank.

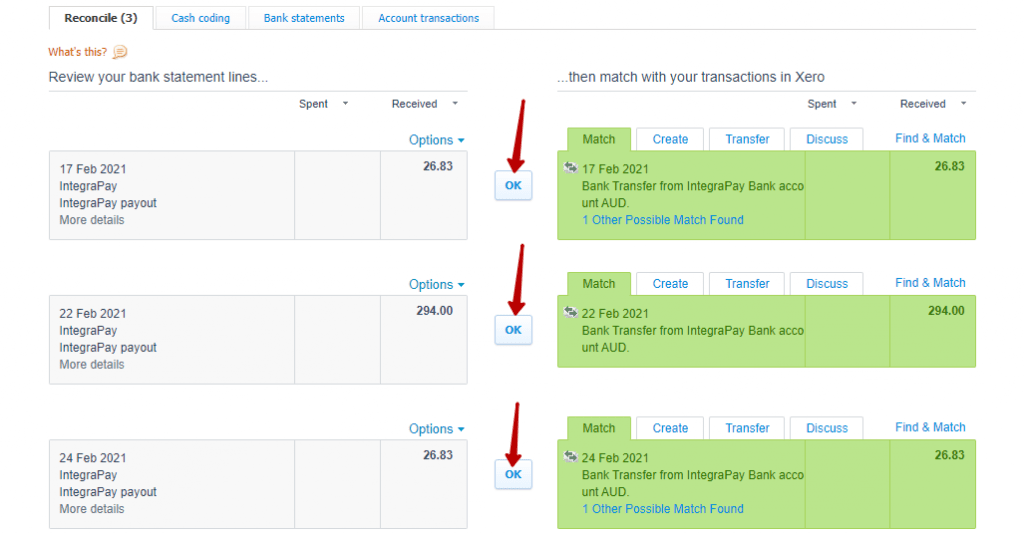

Xero will automatically highlight those pieces that match and all you’ll need to do is click “OK”.

Note: IntegraPay lets you synchronize your sales and fees only when you get settlements for them.

Now that we’ve described the flow, let’s get down to setting things up!

Synder Settings – Configuring Accounts

Synder uses a clearing account which represents your IntegraPay account in Xero, thus money is recorded as sales\refunds from a client to the clearing account, and then once the settlement happens, Synder creates a transfer from clearing to your Checking bank account.

Please, follow the steps below to double check your settings:

- Clearing account reconciliation:

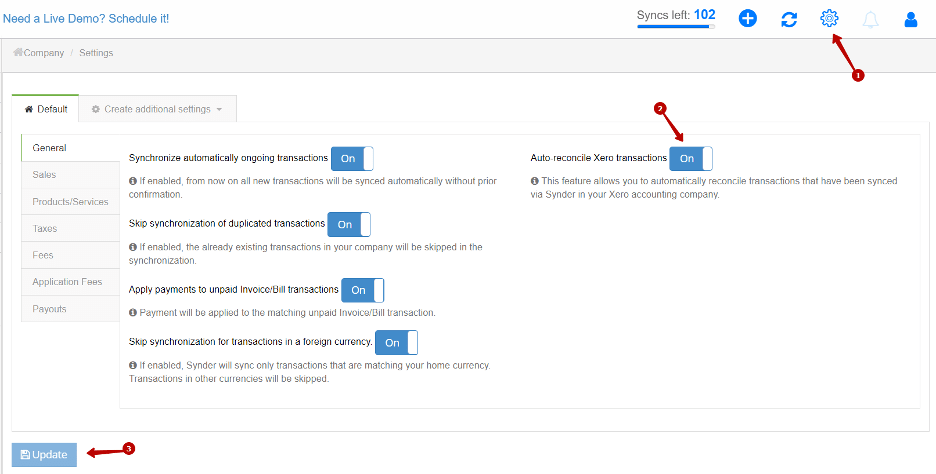

Once you enable the Auto-Reconcile Xero transactions feature, Synder will mark all the sales/refunds/fees transactions as “reconciled” in the clearing account right during the sync.

This setting is Off by default, read more about Synder auto-reconciliation feature. If it is Off, you will see a batch of unreconciled transactions in clearing account.

- Checking account reconciliation:

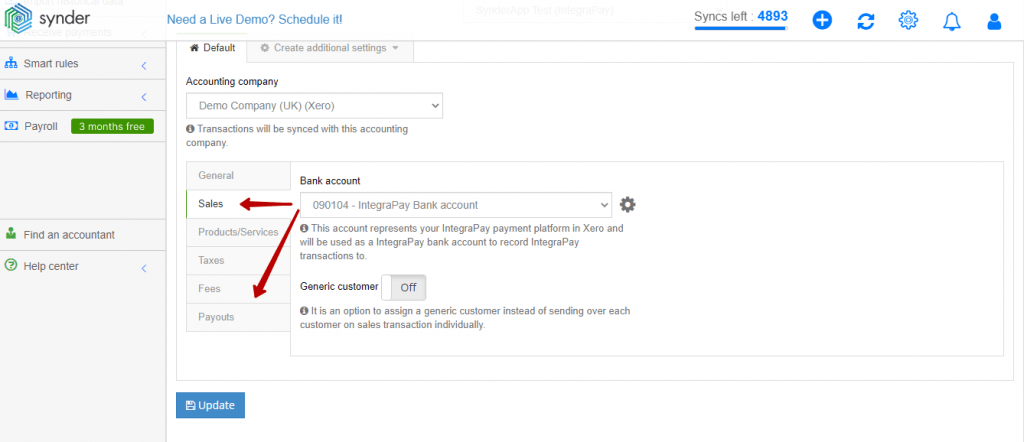

Make sure you have “IntegraPay Bank Account” in Sales and Fees tabs, so that individual transactions are deposited there.

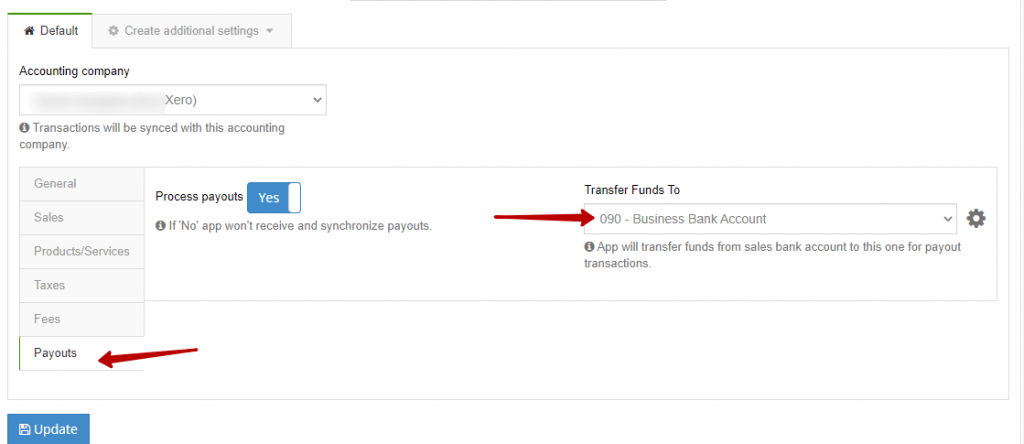

Make sure under the Payouts tab a Checking bank account is selected. Payouts (settlements) setting will simply record transfers needed to zero the balance of the clearing account in your Xero, it will not affect money payouts from IntegraPay to the bank.

Reconciliation flow in Xero

Once your transactions get synchronized into Xero for the time period needed, you will be able to find them in your clearing account in Chart of accounts.

As soon as there is a settlement from your IntegraPay account to your bank account, the transfers and all related charges will appear in Synder and get synced automatically.

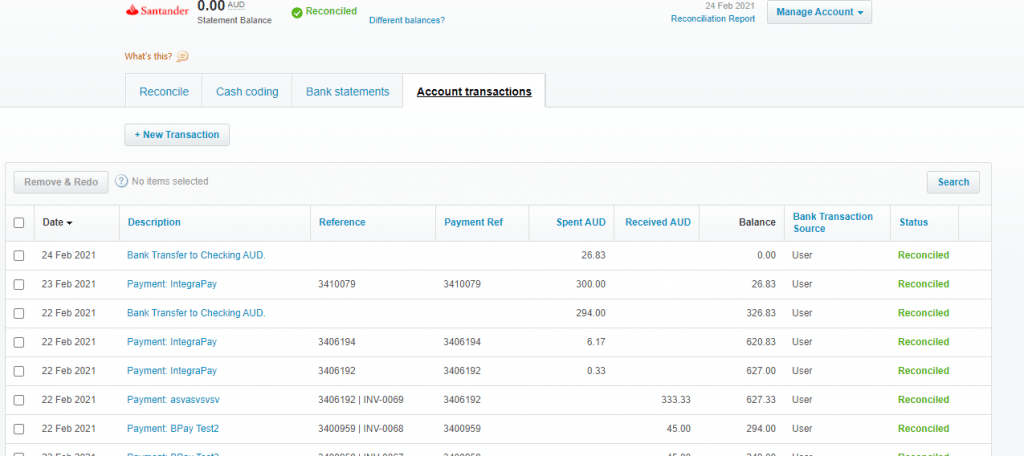

Here is what you will get in your IntegraPay Bank account, as you can see it reflects both individual charges to your clients as well as gross settlement to the bank, making the balance go down to 0 (same way as your IntegraPay has 0 unsettled funds left):

Once Synder synchronizes the settlement and its status says “Synced”, go to Xero Dashboard and find the Checking account. When you open its bank feeds, you will see that Xero has already pre-matched the bank statement lines to the transfers that Synder has brought. This means that Synder did the job for you and now you are ready for smooth reconciliation, just clicking OK for all of your IntegraPay transfers there. That’s what it will look like:

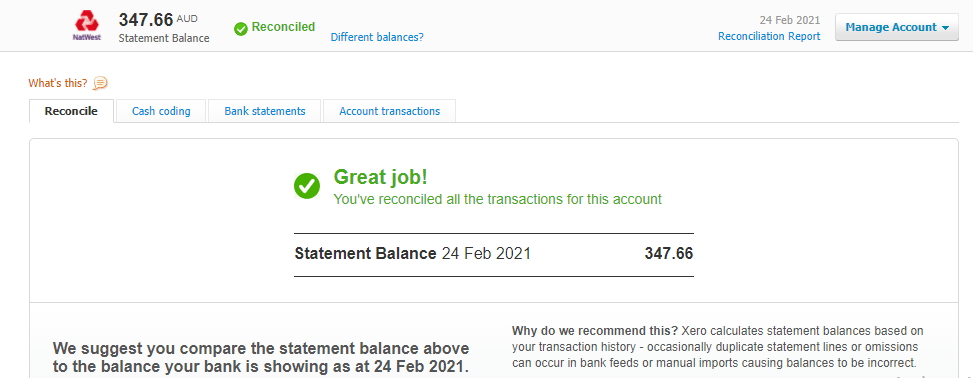

Congrats! Once you match all the IntegraPay settlements this way you are ready to go for seamless reconciliation with Synder.

Congrats! Once you match all the IntegraPay settlements this way you are ready to go for seamless reconciliation with Synder.