Sellers have told us that accounting and bookkeeping for their Etsy shops can be time-consuming and challenging. They dream of getting rid of manual work and simplifying their lives by looking for the perfect finance software for easy cash flow management. Being a smart accounting solution Synder records live transactions automatically, reflecting all essential details such as customers, shipping, discounts, tips, fees and refunds, and helping you track inventory in your books. Categorization and Reconciliation of e-Commerce transactions have never been more precise and easy: all sales, fees and payouts will be automatically recorded in your accounting and reflected in tax, Profit and Loss and Balance sheet reports keep your QuickBooks or Xero reporting accurate and up-to-date in accounting terms.

In this guide, you will learn how to integrate your Etsy store with your accounting software with the help of Synder. Follow easy steps in this helpful guide, and enjoy seamless Etsy synchronization.

Overview:

Start the Esty integration from scratch

1. Create a free trial account

If you’re getting started with Synder you’ll need to create a free Trial account and connect your accounting system first. Check out this guide if you would like to integrate Stripe with Synder accounting, QuickBooks Online or Xero and this article to connect your QuickBooks Desktop company.

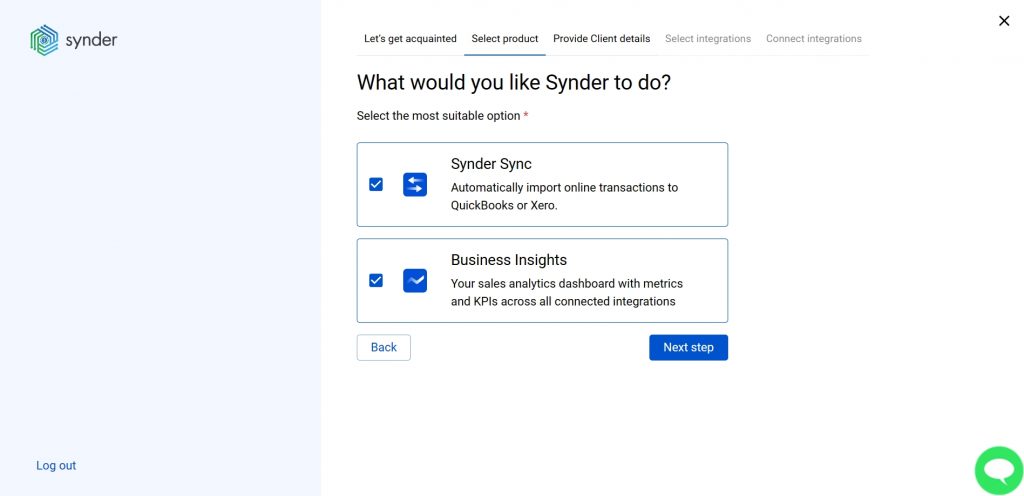

Select the product(s) you are going to use:

- Synder Sync;

- Business Insights;

- Or both of them for perfect control of your business.

Synder Sync: choose this product to push all of your transaction data from all sales channels into QuickBooks Online, QuickBooks Desktop, Xero, or Synder Books – our native accounting solution.

Business Insights: this Synder product lets you see how your business is doing. It aggregates data across all of your connected sales channels and payment gateways and provides you with timely insights into your products’ performance and your customer behaviors, as well as financial health indicators such as total sales, average order value, etc. The data is updated every hour!

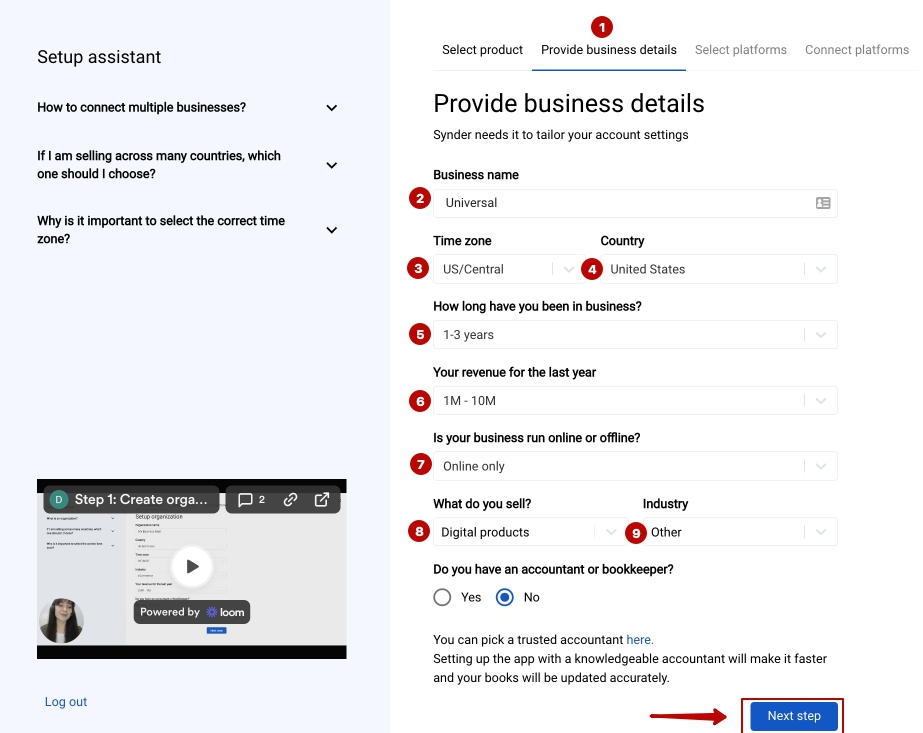

2. Provide your business details

Going through the set-up process of an Organization for your QuickBooks/Xero company or Synder Books – just fill in the information about your business and hit the Next step button.

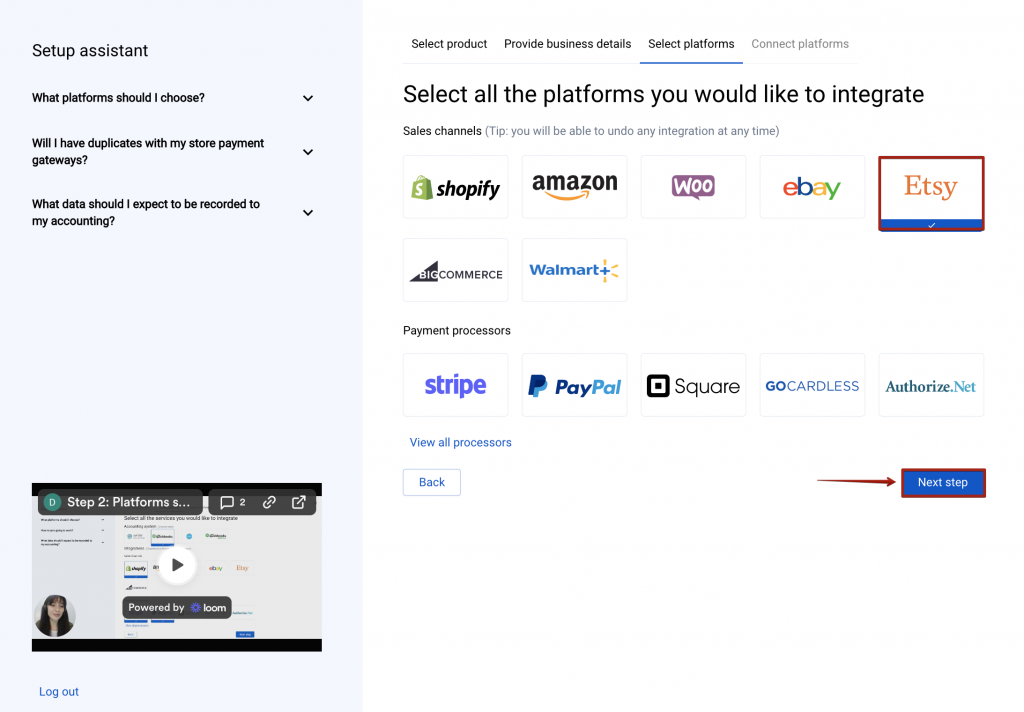

3. Select the platforms you would like to integrate

Now you need to select the platforms you would like to connect to Synder. Mark QuickBooks or Xero, Etsy, and all other sales platforms you would like to integrate with Synder (click View all processors to see the list of all available platforms).

Note: Mark all the services you are using to receive payments, you will be able to connect all of them right away or skip the connection of particular integrations and set them up any time later.

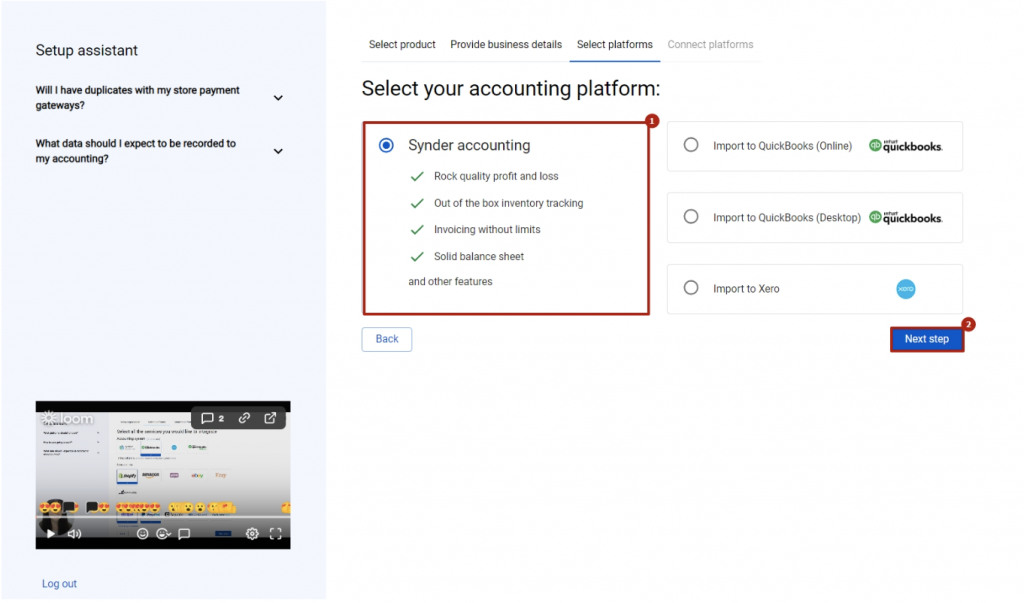

4. Connect your accounting platform

Select your Synder accounting, QuickBooks Online or Xero company by clicking on the Connect button and grant permission to the software to record data in your QuickBooks or Xero company or proceed with our own Synder Books.

Note 2: check out this guide if you would like to integrate QuickBooks Online or Xero.

If you’re going to connect Synder Books, follow the steps on the screen to grant permission to the system

5. Connect your Esty account

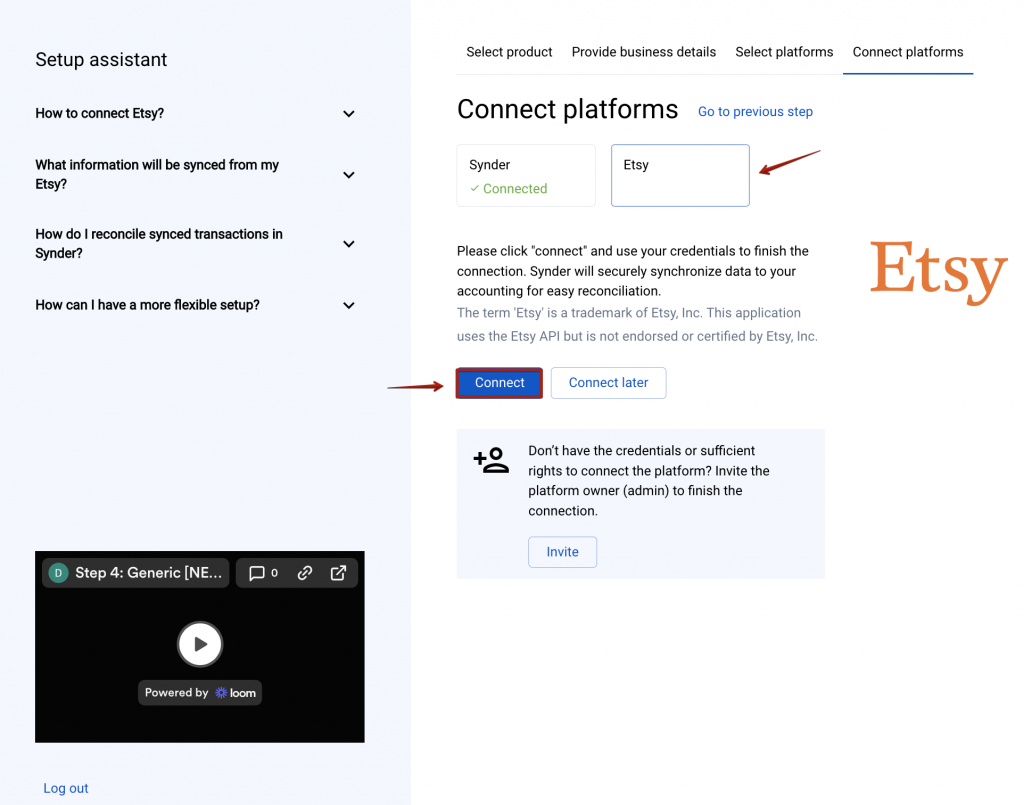

Almost there! To complete the setup, you just need to connect your Etsy and other sales platforms to Synder. You can integrate them one by one straight away, following the steps on the screen: just hit the Connect button:

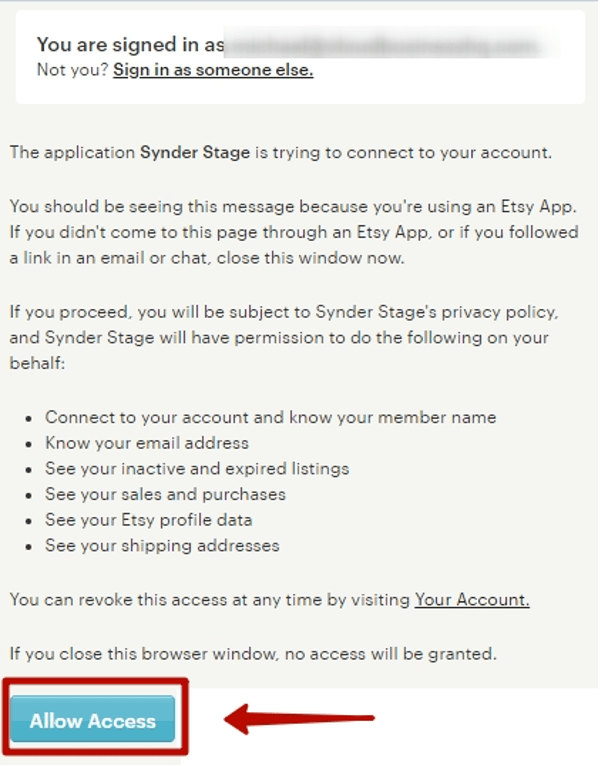

And grant permission to Synder by clicking Allow Access.

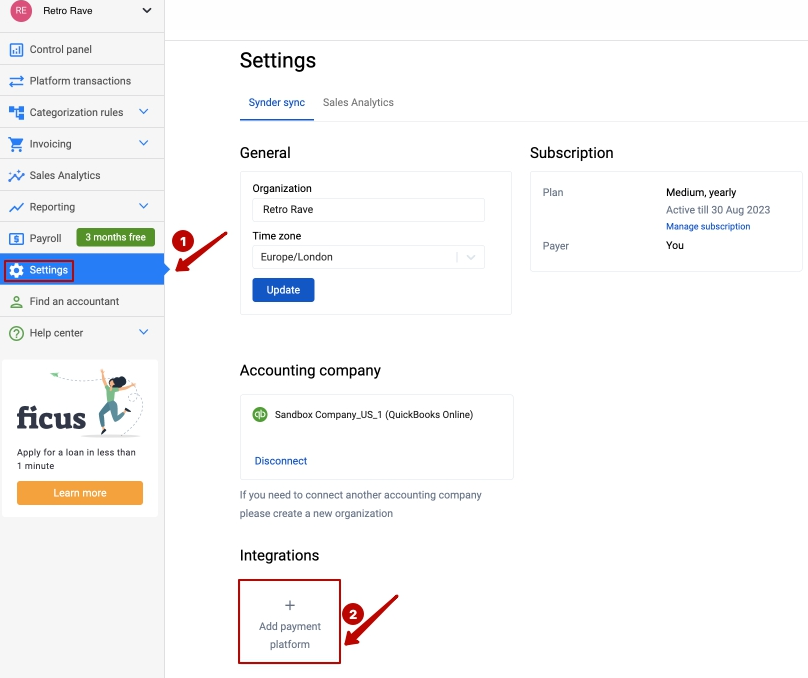

Alternatively, you can skip the connection and set them up later in the Settings: tap the Settings button on the left side menu → hit the Add payment platform button.

Note: You can find our detailed guides on how to connect your sales channels and payment providers to QuickBooks Online/Xero via Synder in our Help center.

6. Set up the Etsy integration

To complete the setup for the Etsy integration, choose an account for payouts (usually, your Checking account) that will allow smooth reconciliation of your Etsy transactions in one click. Hit Continue to finish the configuration.

Connect Etsy to an already existing account

If you already have a Synder account and would like to integrate one more Etsy location, follow the steps below:

1. Switch to the needed Organization in the top-left corner of the Synder page.

2. Navigate to Settings on the left-side menu.

3. In the Payment platforms section and click Add payment platform.

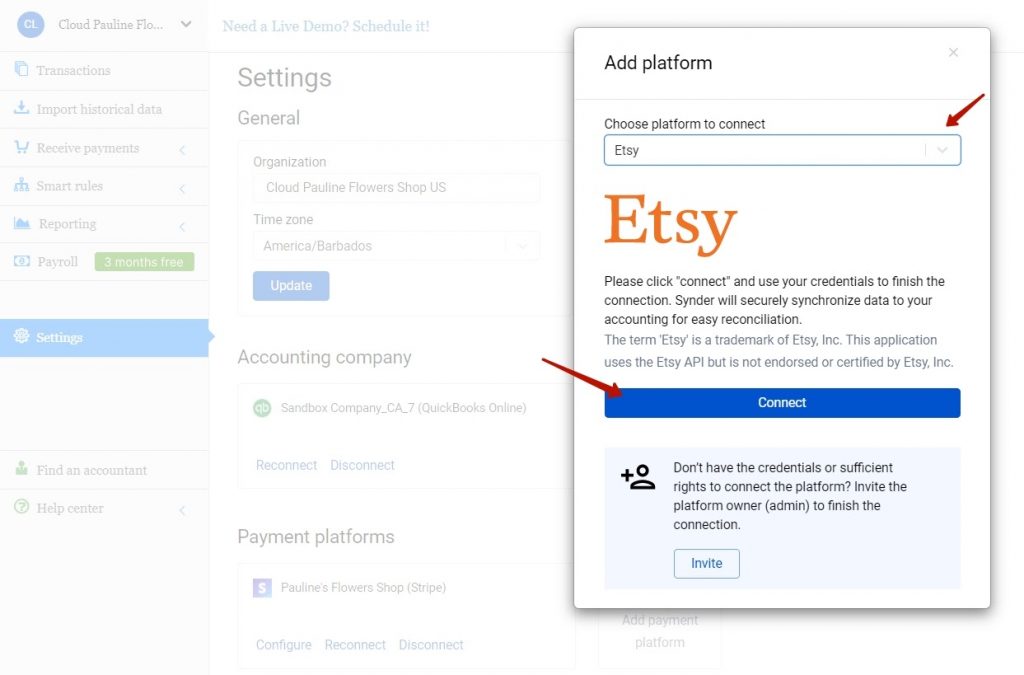

4. Select Etsy in the dropdown and hit the Connect button.

5. To complete the setup for the Etsy integration, choose an account for payouts (usually, your Checking account) that will allow smooth reconciliation of your eBay transactions in one click. Hit Continue to finish the configuration.

Tips and tricks on the Etsy integration

Note 1. Due to agreements with specific states in the USA, Etsy collects taxes on your behalf. However, these taxes are still to be accounted for in your books, as they are associated with your business. Synder will handle it properly and record all the details, including taxes. Check out the article on how taxes withheld by Etsy are processed with Synder for more details.

Note 2. Synder records fees and VAT details from Etsy as separate transactions in your accounting, they will also show up as separate transactions in Synder Transactions list. Learn more How to categorize your Expenses with Synder.

Note 3. Etsy API (API is like a language apps use to talk with each other) won’t let Synder detect customer emails, so Synder software will not be able to transfer customer emails into your QuickBooks or Xero company, however, if there are other customer details in your Etsy sales, Synder will be able to sync them.

Bravo, you have set up the integration between Etsy and Synder! If you feel like some adjustments are necessary, you can manage that in Synder settings. Open them on the left menu → hit the Configure button under your Etsy platform. If you need to fill in gaps with missing data after the sync into your QuickBooks Online, like applying classes or locations to transactions, the Smart Rules feature will be of great service. Now, you can customize your Synder according to your needs.

Get in touch with the Synder team via online support chat, phone, or email with any questions you might have so far – we are always happy to help you!