Overview:

Having connected your accounting company – Xero and your Stripe account (and other payment processors if needed) to Synder financial app, you can start customizing your settings for your Stripe Xero integration.

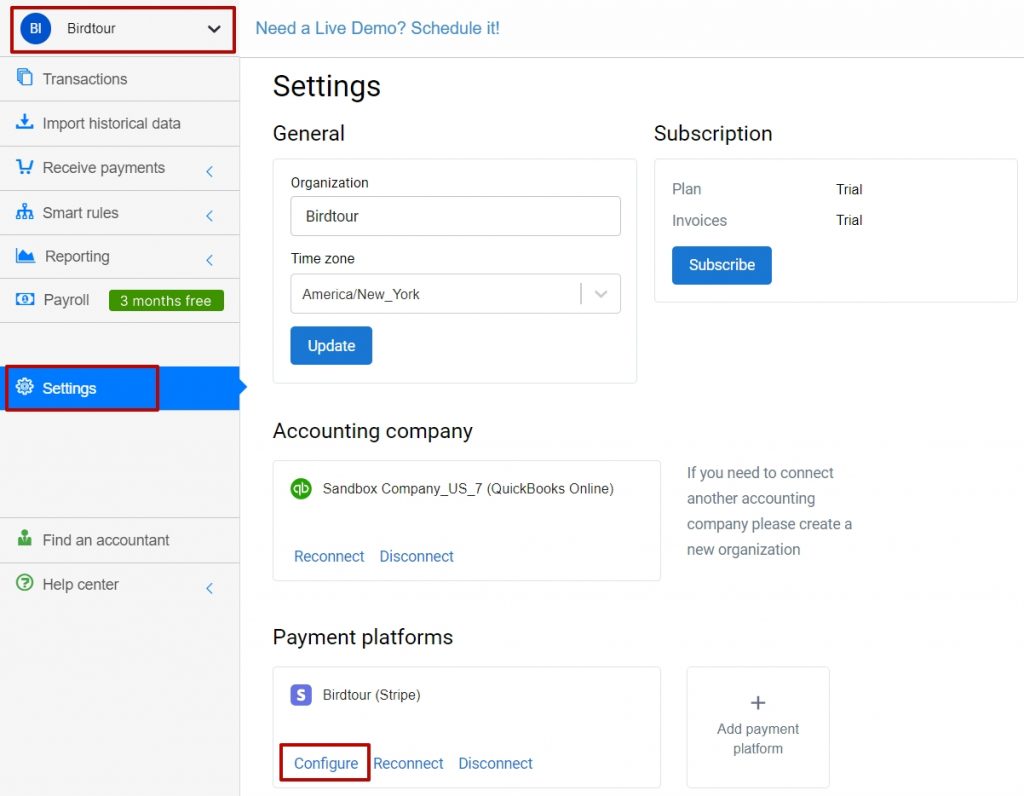

To access ‘Settings’ for the particular payment processor – Stripe in our case (if you have several connected), do the following sequence of actions:

- select the Organization needed at the top right of the page;

- press the ‘Settings’ button on the left-side menu of the app;

- choose the payment platform you want to customize settings for – Stripe account in our case;

- click on the ‘Configure’ button.

1. General tab settings

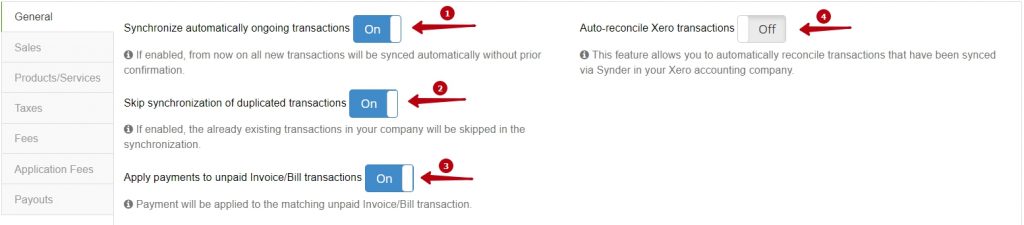

1 – You can enable the ‘Synchronize automatically ongoing transactions’ feature. If enabled, from now on, all new Stripe transactions will be synced automatically without prior confirmation. If you want to sync your Historical transactions, you can also do that with the app – go to the ‘Import Historical Data’ Tab (on the left-side menu), set the period of time, and click on ‘Import’.

2 – ‘Skip synchronization of duplicated transactions’ feature – when “ON”, transactions that already exist in your Xero company will not be synced again.

Note: using transaction’s ID, сustomer name, transaction amount, and date to Synder performs a check for existing transactions in your Xero accounting company. It is 100% protection from duplicates if only Stripe Xero integration is used. However, we cannot guarantee that this feature will protect from duplicates in two cases:

- when you manually created transactions in Xero and then synchronize them using Stripe and Xero integration;

- or you have some transactions created by other apps there.

3 – ‘Apply payments to unpaid Invoice/Bill transactions’ feature – when “ON”, once the system encounters a Stripe Payment that matches an unpaid Stripe Invoice, it will be automatically applied to it.

Note: Stripe Payment will be matched by “Customer name” (it should be 100% match on both sides) and “date” (Stripe Invoice date should be earlier than the date of Stripe Payment) and only to Open invoice. If the Stripe Invoice is closed already in Xero, Synder will create a Sales Receipt; there is no way to link it to the invoice. It should be deleted. Otherwise, it duplicates the income.

4 – ‘Auto-reconcile Xero transactions’ feature – helps to automatically reconcile transactions that have been synced via Synder in your Xero accounting company.

Please, note, that reconciled transactions cannot be rolled back via Synder unless you have them unreconciled on the Xero side first.

2. Sales tab settings

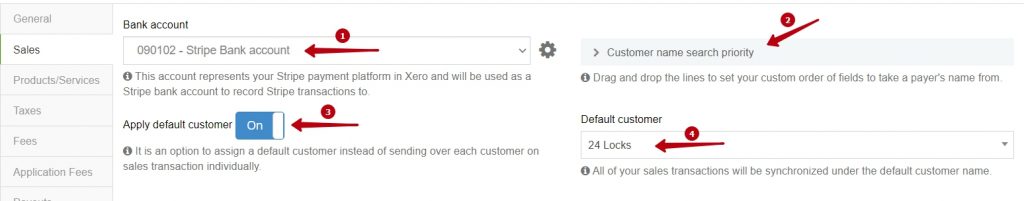

1 – Select a Clearing account for your Stripe transactions here. The app creates Stripe Bank Account for you as a ‘Clearing account’ in your Chart of Accounts in Xero.

2 – ‘Customer mane search priority’ feature – you can prioritize your customer name search on the Stripe side by email, description, shipping address or payment method, etc. Just organize them in the order you need. If there are no customer names in your transaction, the app will check first for the options you have at the top of the list to match the name form there.

3 – ‘Apply default customer’ feature helps you to assign the customer to your transaction. You may choose the name of the default customer from the drop-down menu (4), and all your transactions will be synced under the name of this default customer selected.

Note: use this feature if there are some problems with native names (such as specific symbols) or if you need to apply only one customer for all the transactions.

3. Products and Services tab settings

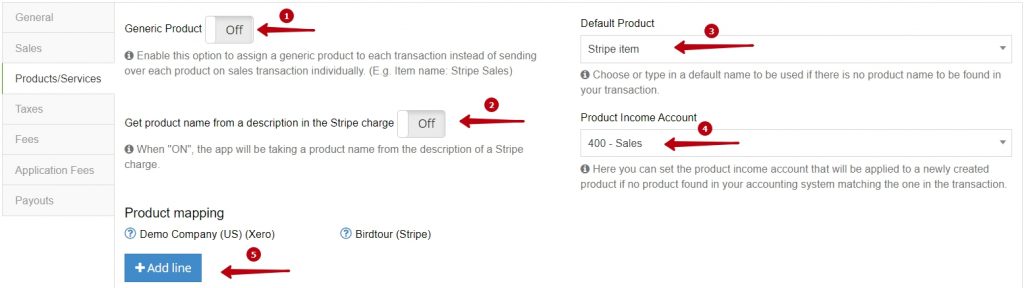

1 – ‘Generic Product’ feature – enabling this feature will replace the name of the product from your transaction to selected in the Generic Product name

2 – ‘Get the name of the product from the description in the Stripe charge’ – make sure you have only one product name in the description field.

3 – ‘Default Product’ – choose or type in this field a name to be used if there is no product name to be found in your Stripe transaction.

4 – ‘Product Income Account’ – you need to set the account the new products will be associated with when they are automatically created by the app. All existing products will be matched in case names are the same on Stripe and Xero sides.

5 – ‘Product mapping’ feature – Synder is able to identify existing products in your accounting company and apply them to transactions. If product names in your payment system and accounting company don’t match 100%, please, fill in the product names from your payment platform in the right field to map them to product names from your Xero in the left field.

Let’s say you have a product “Apple” in Xero and “Green Apples” and “Red Apples” products in your Stripe so using the feature you can match them so that “Green Apples” and “Red Apples” from Stripe will be matched to already existing “Apple” in Xero instead of creating a new product. Note that the product mapping will also work for items specified in the Stripe charge description.

4. Taxes tab settings

For e-commerce businesses, sales tax calculation may become challenging as there are many sales channels and payment platforms included in the purchase process.

Synder transfers over existing taxes into Xero respective fields so that everything will be correct in your tax reporting. However, note, if there is no tax on the payment processor side – Stripe, there is nothing to transfer over and we will not generally apply taxes to synced transactions (only some options like the ‘Apply generic tax’ feature may be used).

Taxation works differently for the US and Non-US QBO companies, so the settings in Synder for taxes are also different for US and Non-US companies.

Enable fees processing only if you tax your clients on the Stripe side (and taxes are reflected in your Stripe); then the app will account for them correctly.

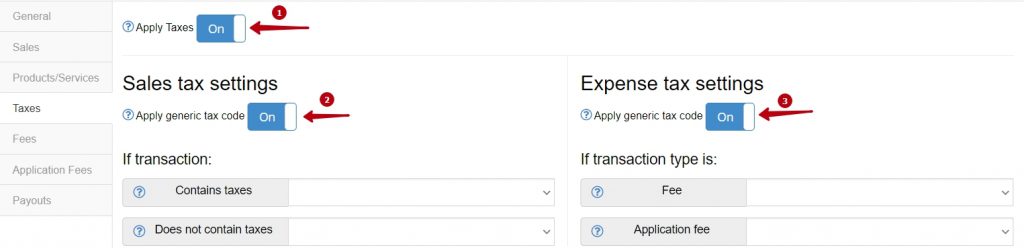

1 – ‘Apply taxes’ feature. Synder calculates the tax rate (%) based on the transaction total and tax amount coming from your Stripe account. Then it compares this tax rate against the tax codes sitting in your accounting company – Xero.

When it’s “ON”, the system will search for a matching tax code. In case the system cannot find it, a tax amount will be included in the total sum. If you enable this feature, then taxes from your Stripe merchant account will be properly reflected (as taxes) in your Xero. If you disable the taxes, the app will put the amount into a separate product line in the transaction.

2 – Sales tax settings. ‘Apply generic tax code’ feature – when “ON”, the app will apply the tax rate you specify in the settings to both taxable and non-taxable Stripe Sales transactions you sync with Stripe Xero Integration.

3 – Expense tax settings. ‘Apply generic tax code’ feature – when “ON”, the app will apply the tax rate you specify in the settings to both taxable and non-taxable sales transactions you sync with the app.

5. Fees tab settings

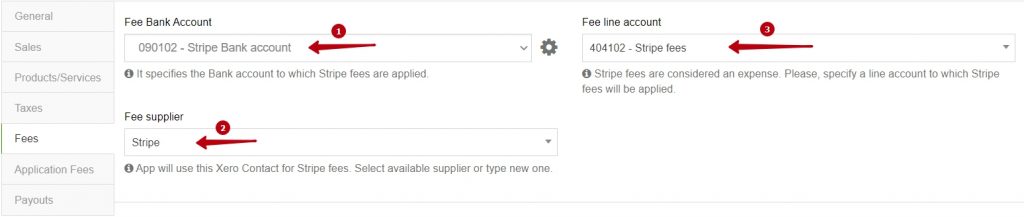

1 – ‘Bank account’ – this setting specifies the bank to which the Stripe fees are applied. Please, note that fees account and sales accounts should be the same. We recommend using ‘Stripe Bank Account’ for it.

2 – ‘Fee Supplier’ – the app will use this Xero Supplier to associate with your Stripe fees. Select available, or type in a custom one, like “Stripe”.

3 – ‘Fee line account’ – select the account your Stripe fees will be applied to.

6. Application fees tab settings

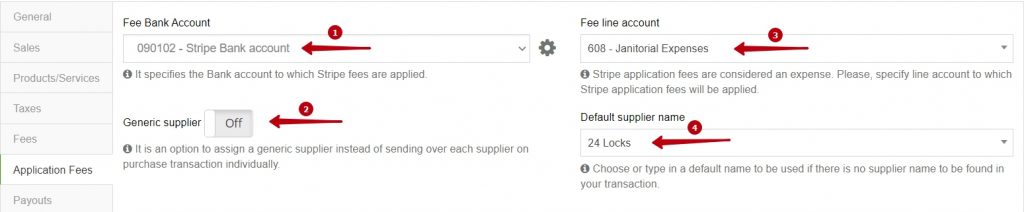

1 – ‘Fee Bank account’ – this setting specifies the bank to which the Stripe application fees for processing credit card payments are applied. We recommend using the same Bank account as in the Sales settings.

2 – ‘Generic Supplier’ – when “ON”, it assigns a default vendor name to all of your Stripe transactions replacing names going from payment processor – Stripe. Click on the drop-down under “Generic vendor name” to select a name. Choose from existing ones or type in a custom name.

3 – ‘Fee line account’ – this setting specifies the category to which the application fees are applied.

4 – ‘Default supplier name’ – сhoose or type in a default name to be used if there is no vendor name to be found in your Stripe transaction.

7. Payouts tab settings

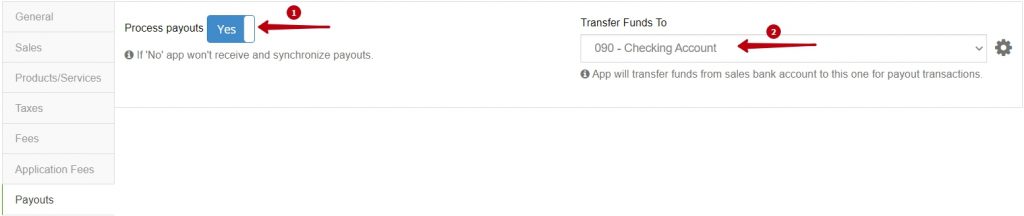

This tab allows tracking Stripe Payouts – bulk daily/monthly/weekly/etc. money transfers from your payment processor to the bank. The app will record them in an accounting company as a Transfer from/to clearing account to/from checking account. Payouts synchronization is needed to make the reconciliation process easier for you – by syncing Sales transactions (and expenses) along with the Payouts, Synder mirrors the actual money flow happening in your payment platform.

1 – Process payouts – when “ON”, the app will track and create deposit receipts reflecting Stripe Payouts to your checking account.

Note: if the payouts setting is disabled in Synder, you will not see any Stripe payouts in the transactions list, and they will not be synchronized to your accounting company.

2 – Transfer funds to – please select your checking account here.

Once you receive online payments from your clients – money first goes to your payment processor and accumulates there, and a payment processor makes a transfer (payout) to your real bank account (at the end of the day or at your customized payouts frequency). Synder syncs all individual sales and expense transactions into the Clearing account initially. Once the payout happens, the app creates the transfer from the clearing to your checking account, reflecting the actual money flow. So all you need to do for reconciliation is to open the Banking section in Xero and match the info synced by Synder with real money transfers to your bank (matches are found automatically by Xero).

Learn more about Stripe integrations that Synder offers:

Note: the Synder app can connect as many payment platforms as you need.

Do you have any questions? We would love to hear from you. Please, contact us via online support chat, phone, or email.