According to experienced business specialists the key to gain new customers is to cover more channels of communication with potential clients. Sales platforms such as Stripe, PayPal, Shopify and eBay provide your customers with an easy and convenient way to complete purchases online so that business owners can enjoy the benefits of an incoming stream of customers. However, many business owners struggle handling the accounting part that might seem tricky at first glimpse.

This is where Synder comes into play, being a smart accounting software Synder mirrors the actual money flow happening in your Stripe and records live transactions and historical data in your accounting system providing you with precise tax, customer, item and other transaction details. With the Synder solution you will be able to reconcile synced data in one click, track inventory and manage Accounts Receivable by closing open QuickBooks invoices with Stripe payments automatically.

Follow easy steps in this helpful guide, and enjoy seamless synchronization with Synder.

Overview:

Start the Stripe integration from scratch

- Create a free trial account

If you’re getting started with Synder you’ll need to create a free Trial account and connect your accounting system first. Check out this guide if you would like to integrate Stripe with Synder accounting, QuickBooks Online or Xero and this article to connect your QuickBooks Desktop company.

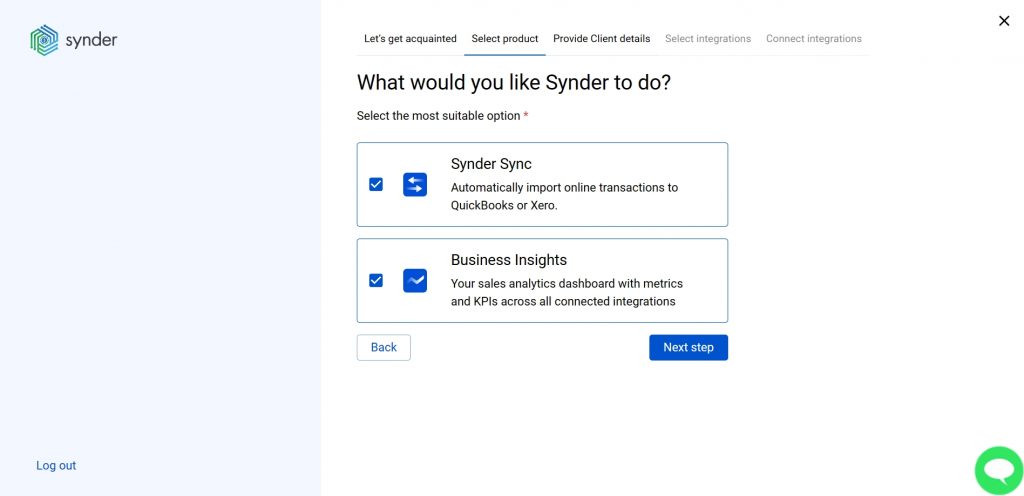

Select the product(s) you are going to use:

- Synder Sync;

- Business Insights;

- Or both of them for perfect control of your business.

Synder Sync: choose this product to push all of your transaction data from all sales channels into QuickBooks Online, QuickBooks Desktop, Xero, or Synder Books – our native accounting solution.

Business Insights: this Synder product lets you see how your business is doing. It aggregates data across all of your connected sales channels and payment gateways and provides you with timely insights into your products’ performance and your customer behaviors, as well as financial health indicators such as total sales, average order value, etc. The data is updated every hour!

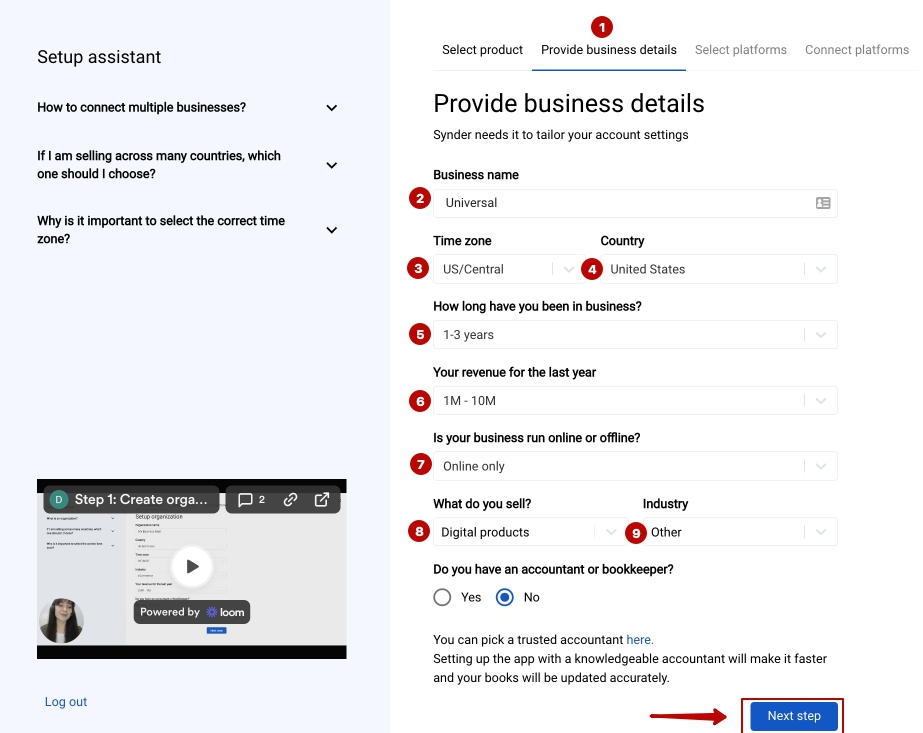

- Provide your business details

Going through the set-up process of an Organization for your QuickBooks/Xero company or Synder Books – just fill in the information about your business and hit the Next step button.

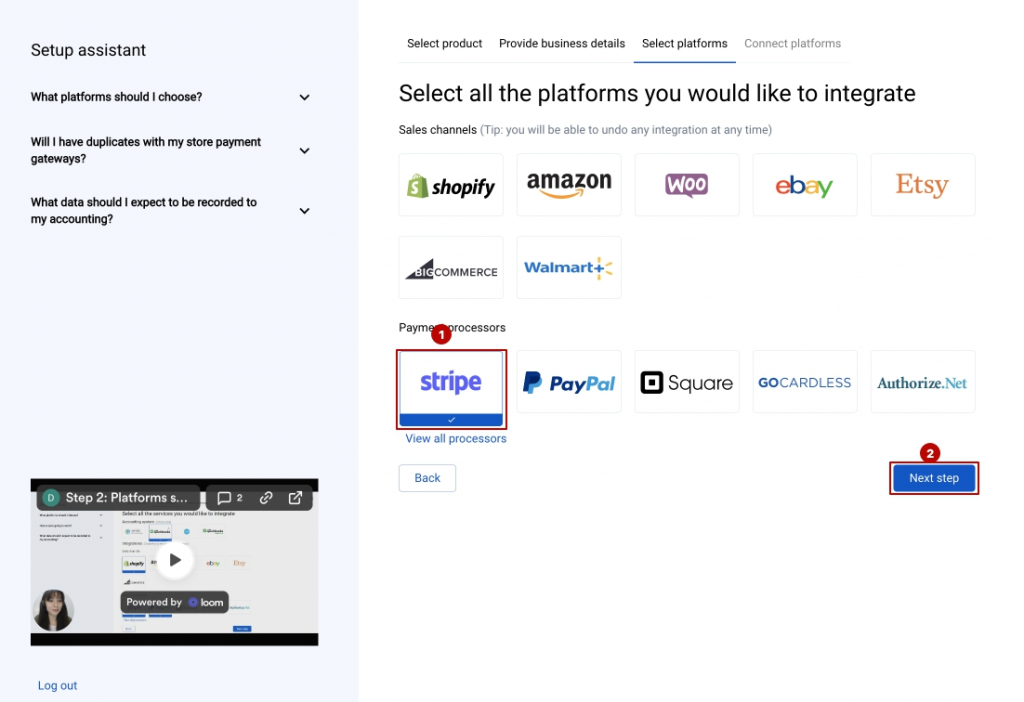

- Select the platforms you would like to integrate

Now you need to select the platforms you would like to integrate with Synder. Select Stripe and other sales platforms you would like to integrate with Synder (click View all processors to see the list of all available platforms).

Note: Select all the services you are using to receive payments. You will be able to connect all of them right away or skip the connection of particular integrations and set them up any time later.

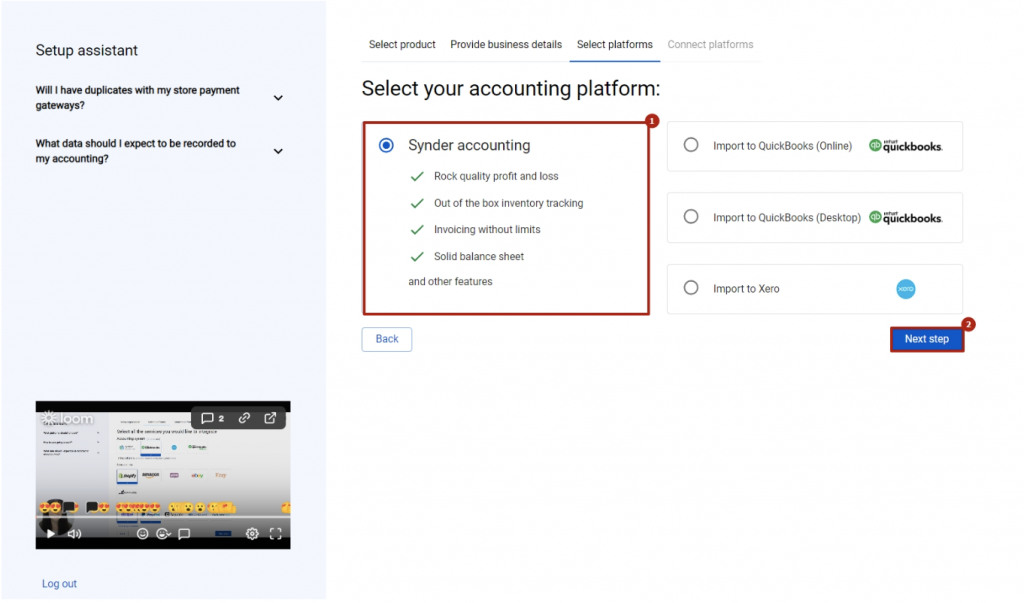

- Select and connect your accounting platform

Select your QuickBooks Online or Xero company by clicking on the Connect button and grant permission to the software to record data in your QuickBooks or Xero company or proceed with our own Synder Books.

Note 1: if you are a QuickBooks Desktop user, check out this video tutorial to learn How to connect and sync data into QuickBooks Desktop.

Note 2: check out this guide if you would like to integrate QuickBooks Online or Xero.

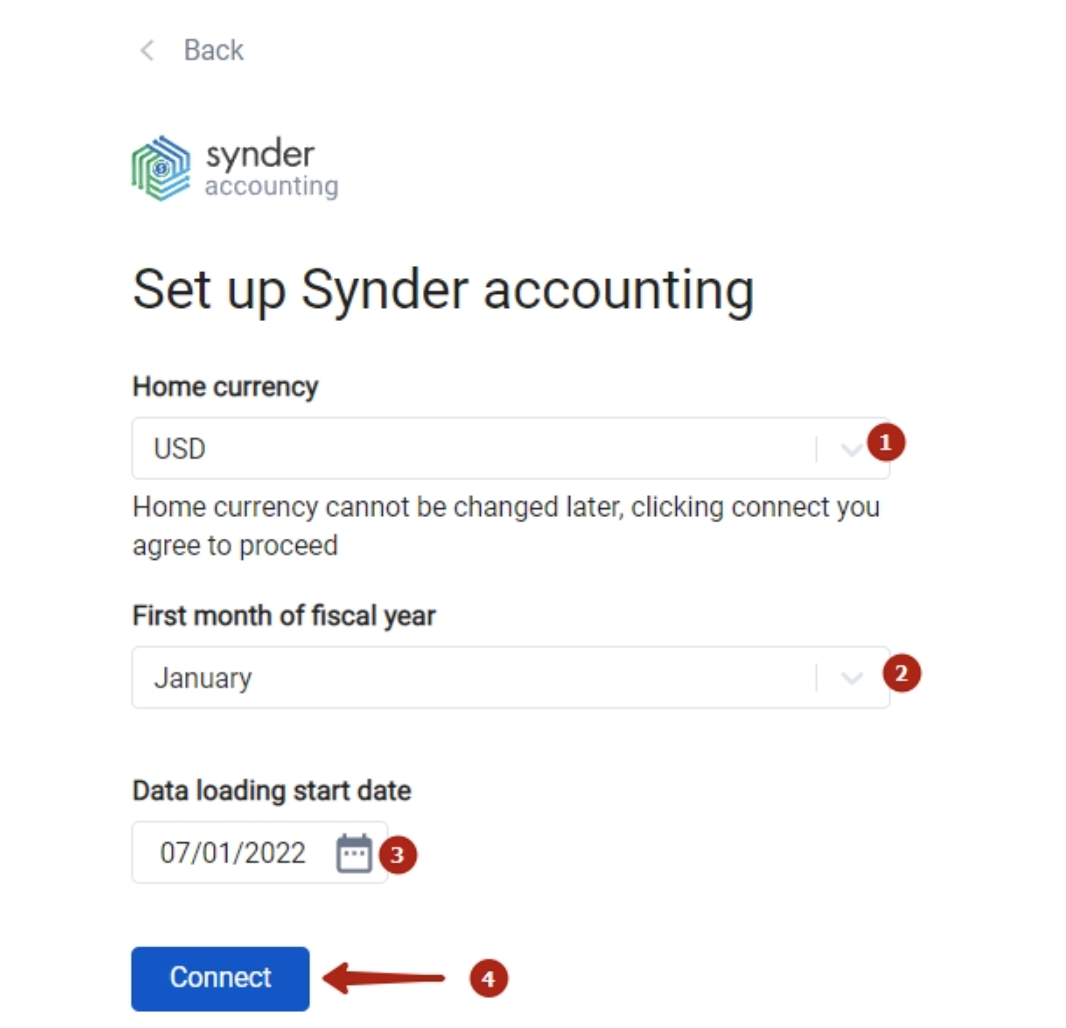

If you’re going to connect Synder Books, follow the steps on the screen to grant permission to the system

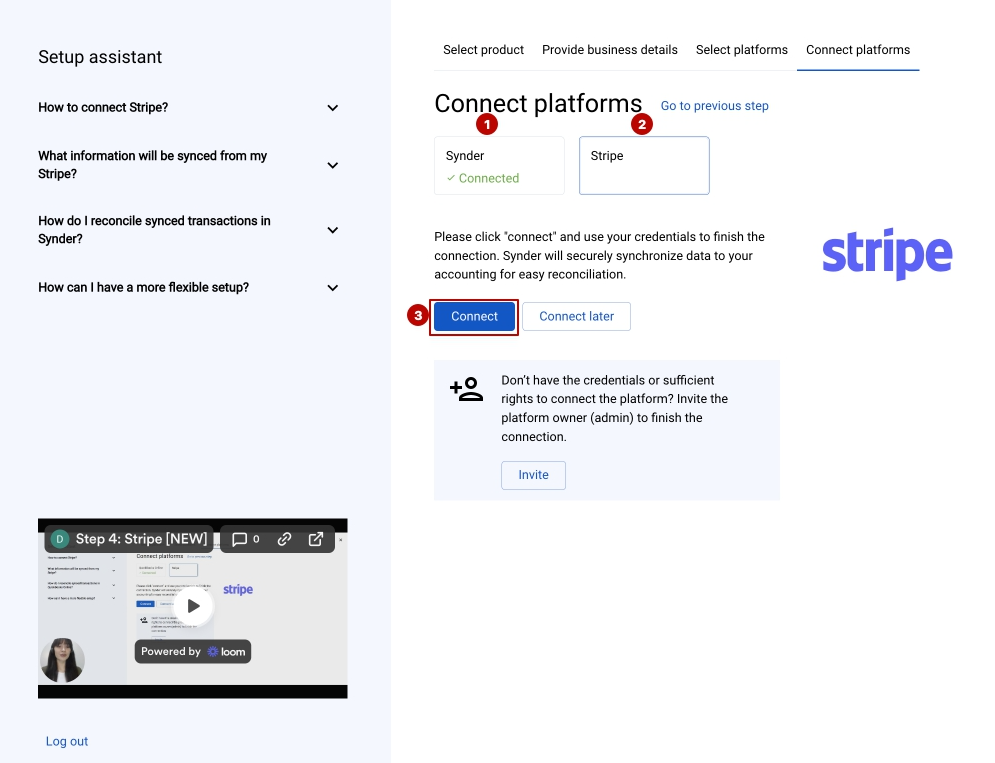

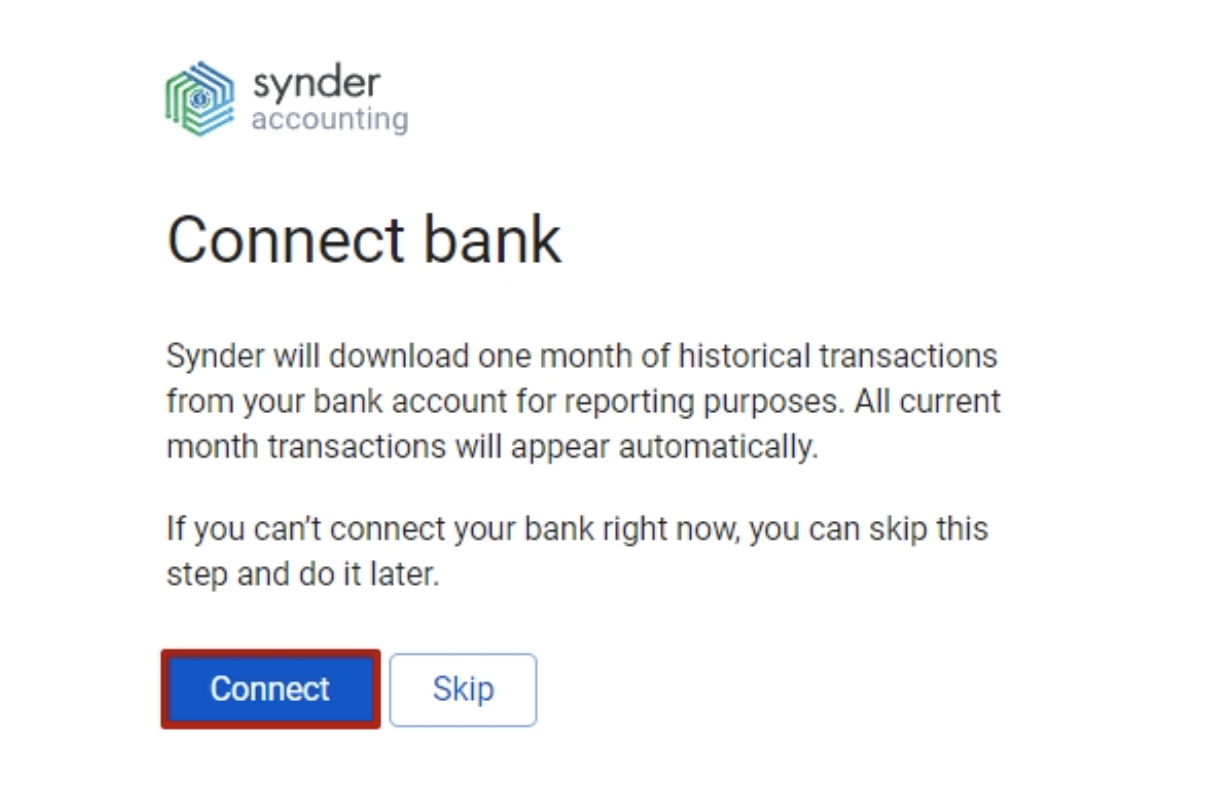

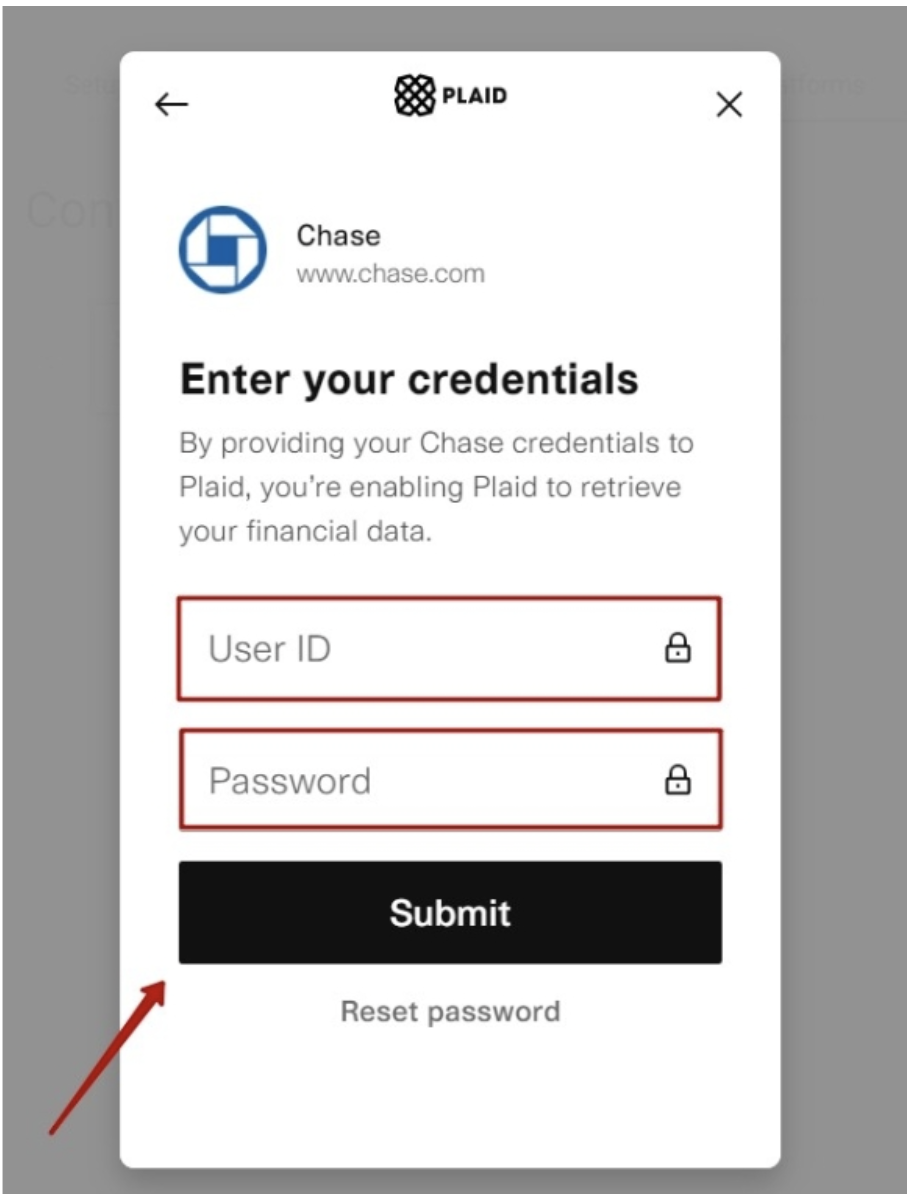

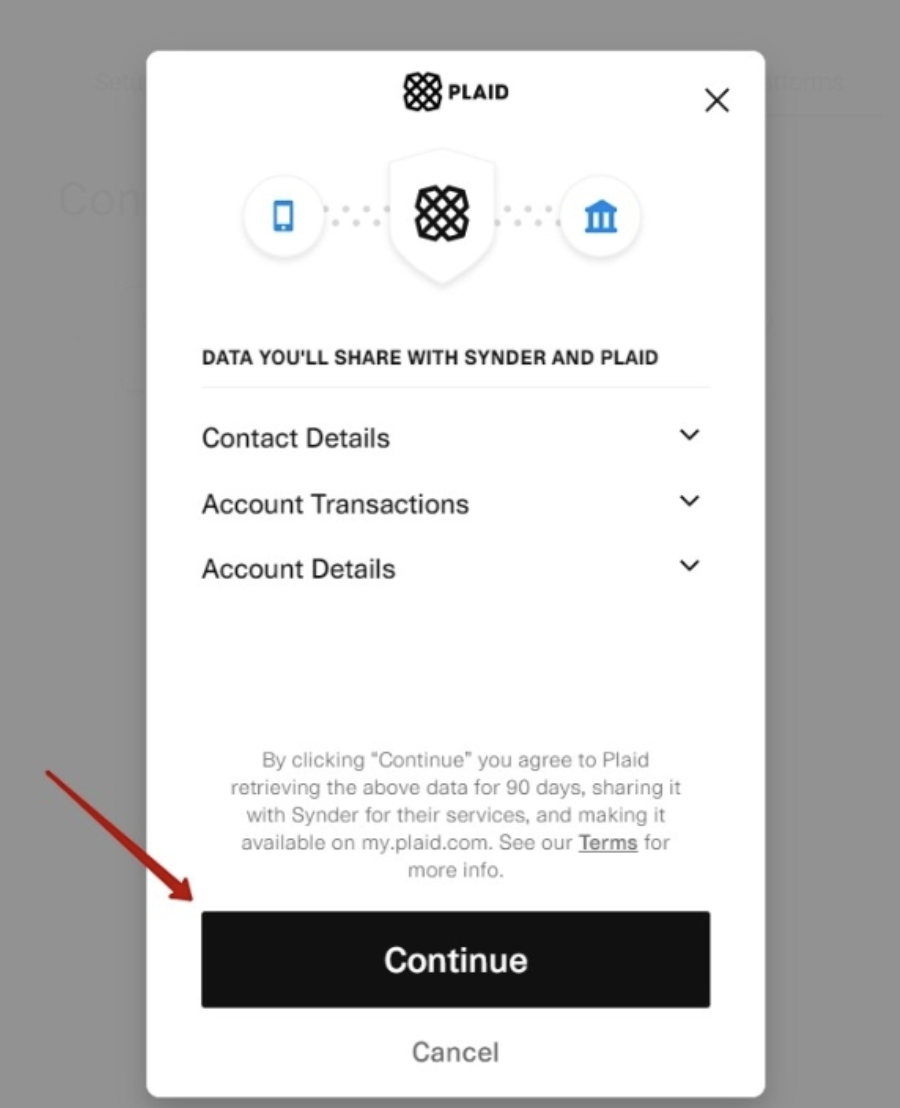

- Connect your Stripe account

Almost there! To complete the setup you just need to connect your Stripe and other sales platforms to Synder. You can integrate them one: just hit the Connect button → grant permission to Synder.

Note: You can find our detailed guides on how to connect your sales channels and payment providers to Synder accounting/QuickBooks Online/Xero via Synder in our Help center.

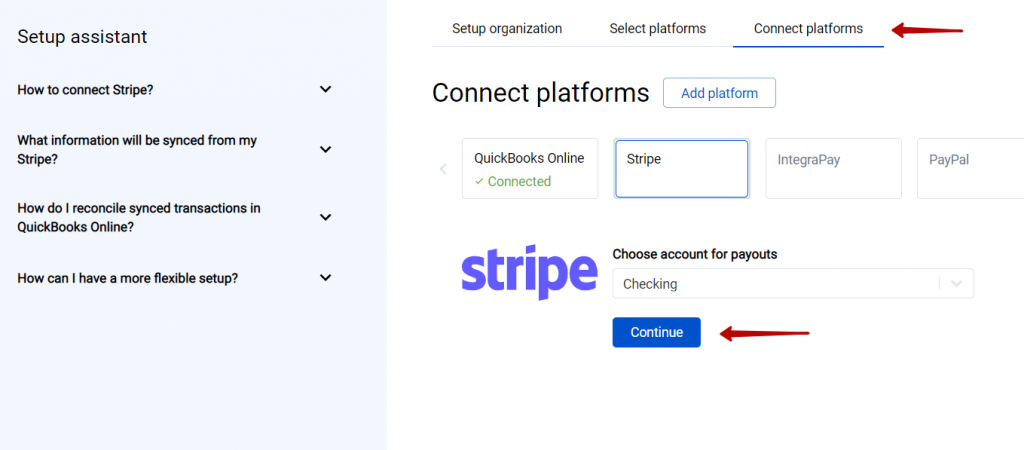

- Set up the Stripe integration

To complete the setup for the Stripe integration choose an account for payouts (usually, your Checking account) that will allow smooth reconciliation of your Stripe transactions in one click.

Connect Stripe to an already existing account

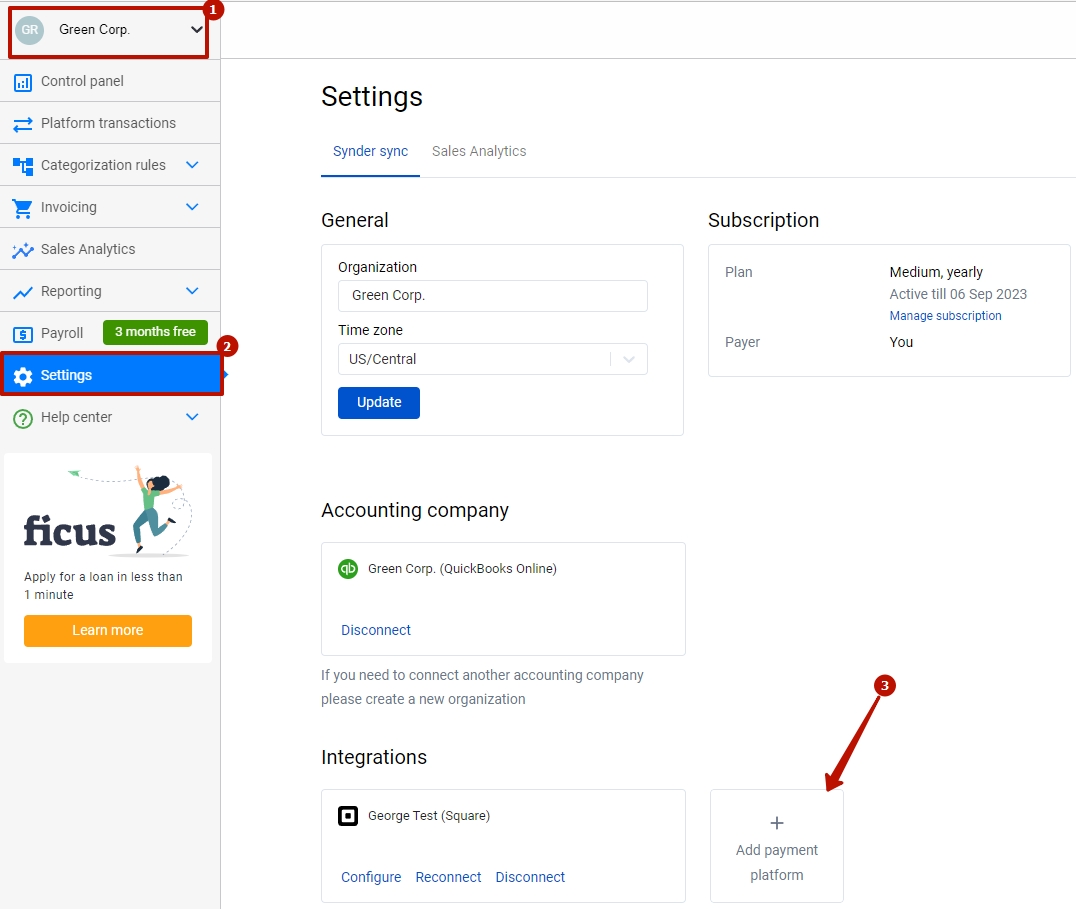

If you already have a Synder account and would like to integrate one more Stripe account follow the steps below:

1. Switch to the needed Organization in the top-left corner of the Synder page.

2. Navigate to Settings on the left-side menu.

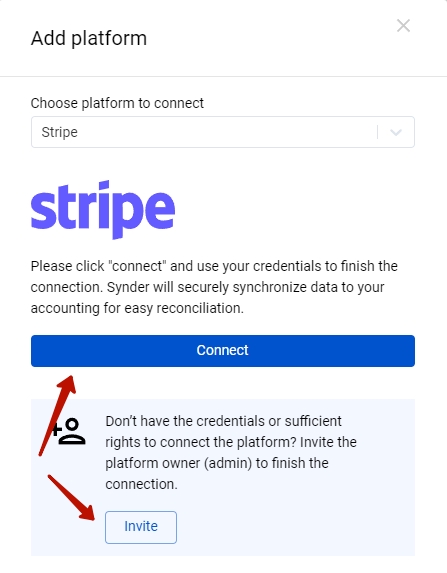

3. In the Integrations section and click Add payment platform – > select Stripe in the dropdown and hit the Connect button

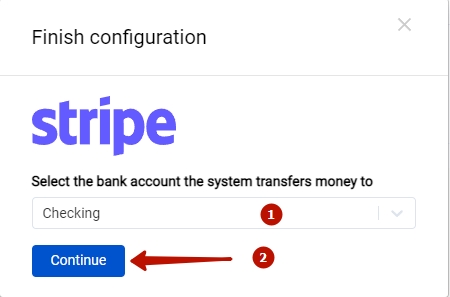

4. To complete the setup for the Stripe integration choose an account for payouts (usually, your Checking account) that will allow smooth reconciliation of your Stripe transactions in one click. Hit Continue to finish the configuration.

Tips and tricks on the Stripe integration

Note 1. Synder does not support connecting of Stripe Express accounts at the moment.

Note 2. Synder parses financial paydowns, adjustments, transfers – almost every transaction type from Stripe.

Note 3. Stripe payments made in the test mode will not show up in Synder. Syncing your live data from Stripe with Synder you will always have an option to undo any action and the software will skip all the duplicates if you try to sync the same data twice.

Note 4. If your Stripe is linked to an e-Commerce store, connect both your Stripe and e-Commerce account to get all order and payment details synced to your books.

Bravo, you have set up the integration between Stripe and Synder! If you feel like some adjustments are necessary, you can manage that in Synder settings. Open them on the left menu → hit the Configure button under your Stripe platform. If you need to fill in gaps with missing data after the sync into your QuickBooks Online, like applying classes or locations to transactions, the Smart Rules feature will be of great service. Now, you can customize your Synder according to your needs.

Get in touch with the Synder team via online support chat, phone, or email with any questions you might have so far – we are always happy to help you!

Stripe posts the net amount not the gross and fee separately. How can I fix that?

Hello Pat,

Stripe net amounts must be payouts. Synder syncs both your payouts and your sales with fees. So after syncing them all, you can reconcile your Stripe account with the clearing account in QBO, where we sync your sales, fees and payouts.

Also, please contact our support team via online chat or support email and after checking your account we will be able to provide you with the solution. We are always ready to help!