This guide will teach you how to integrate Amazon with your accounting system (connect Amazon to Synder accounting, QuickBooks or Xero). Learn more about QuickBooks Amazon integration. Once you set it up (don’t worry, it is pretty quick and straightforward), Synder will funnel the data from your Amazon account with all the detailed customer, item, tax and other information right into your accounting system. Just follow the simple steps below and enjoy seamless synchronization.

Overview:

Start Amazon integration from scratch

If Amazon is your first integration with Synder you will need to connect your Synder accounting, QuickBooks or Xero company first. There are 2 ways you can log into Synder, so 2 ways Quickbooks Online and Xero can be connected to the software.

1. Create an account

If you’re getting started with Synder you’ll need to create a free Trial account and connect your accounting system first. Check out this guide if you would like to integrate Amazon with Synder accounting, QuickBooks Online or Xero and this article to connect your QuickBooks Desktop company.

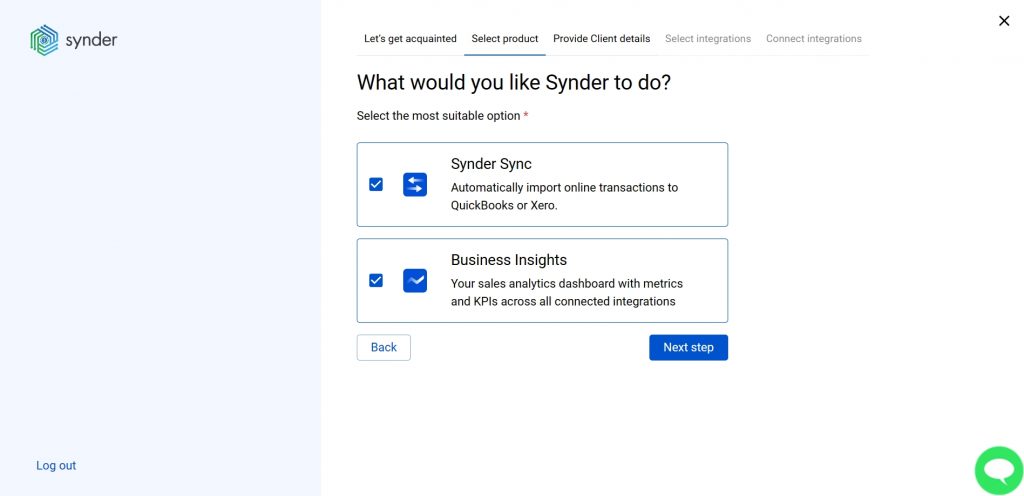

Select the product(s) you are going to use:

- Synder Sync;

- Business Insights;

- Or both of them for perfect control of your business.

Synder Sync: choose this product to push all of your transaction data from all sales channels into QuickBooks Online, QuickBooks Desktop, Xero, or Synder Books – our native accounting solution.

Business Insights: this Synder product lets you see how your business is doing. It aggregates data across all of your connected sales channels and payment gateways and provides you with timely insights into your products’ performance and your customer behaviors, as well as financial health indicators such as total sales, average order value, etc. The data is updated every hour!

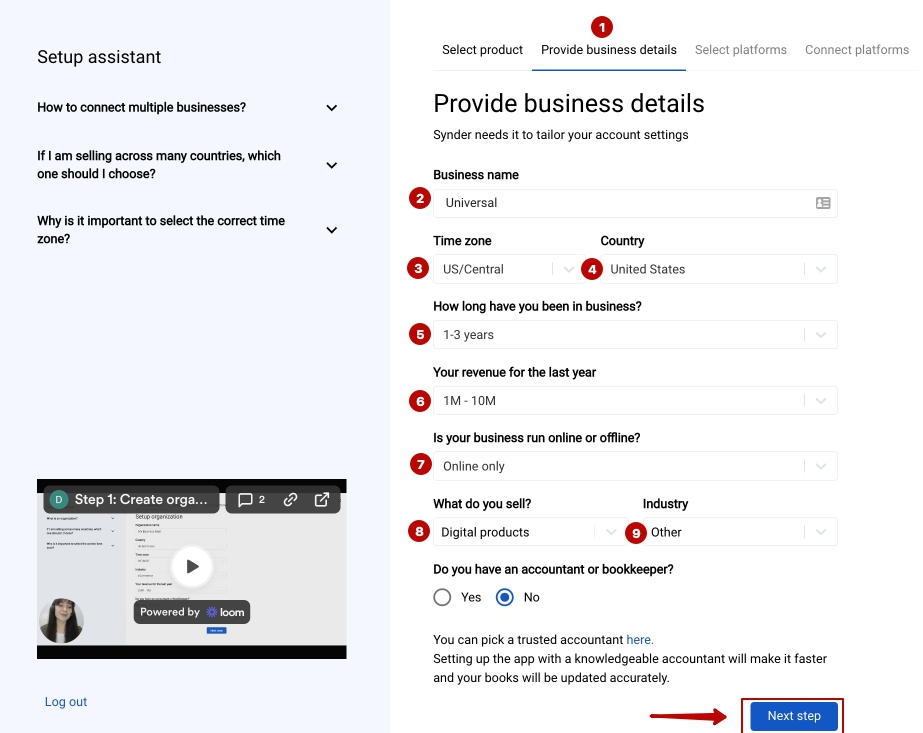

2. Provide your business details

Going through the set-up process of an Organization for your QuickBooks/Xero company or Synder Books – just fill in the information about your business and hit the Next step button.

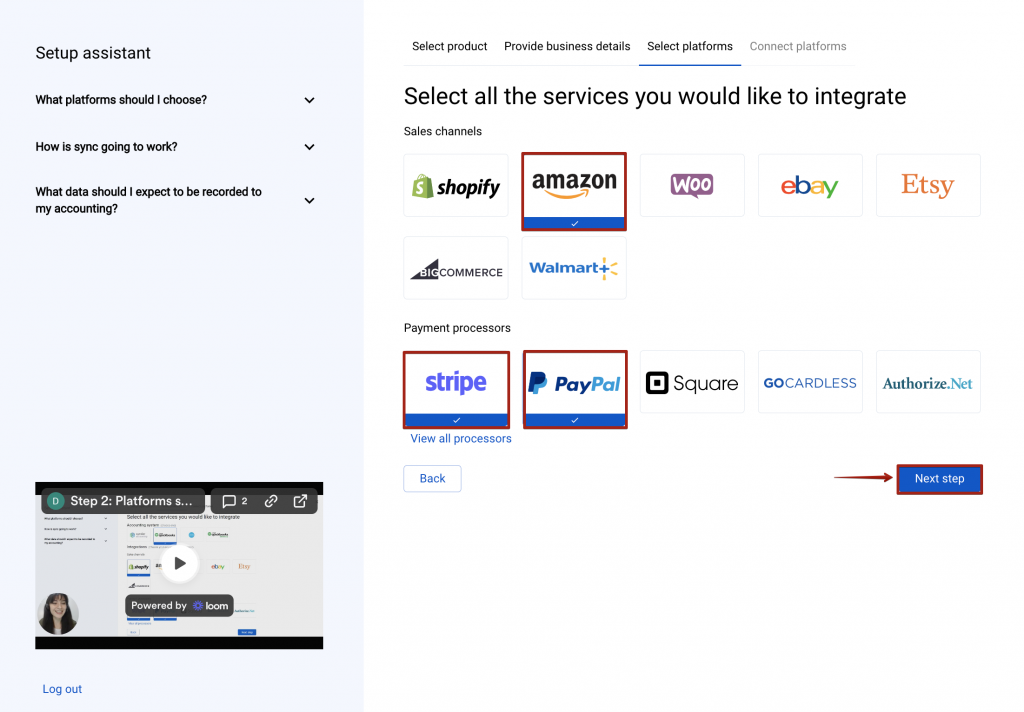

3. Select the platforms you would like to integrate

Now you need to select the platforms you would like to integrate with Synder. Select Amazon and all sales platforms you would like to integrate with the software (click View all processors to see the list of all available platforms).

Note: Select all the services you are using to receive payments. You will be able to connect all of them right away or skip the connection of particular integrations and set them up any time later.

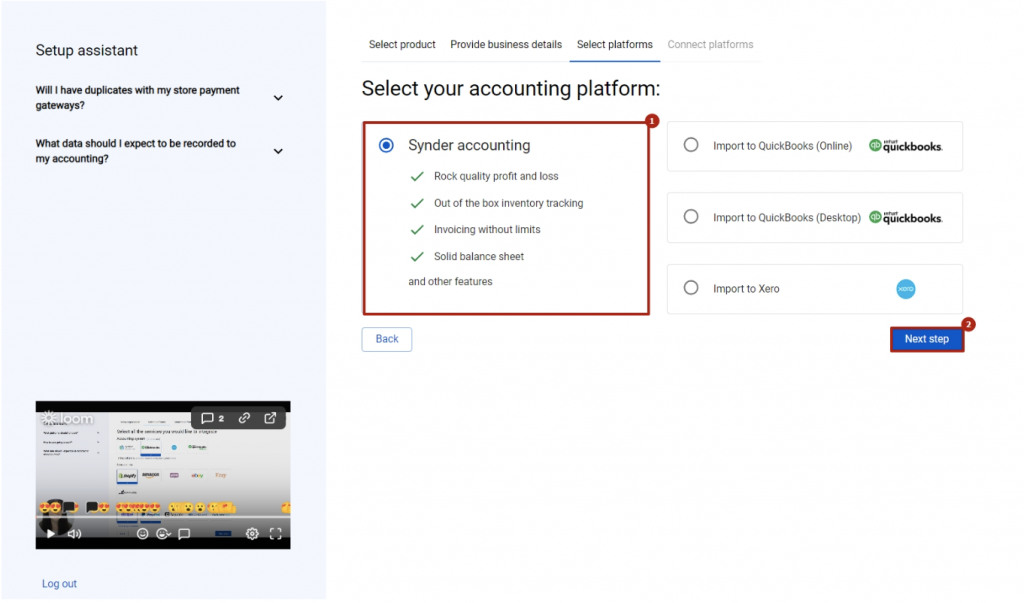

4. Connect your accounting platform

Select your QuickBooks or Xero company by clicking on the Connect button and grant permission to the software to record data in your QuickBooks or Xero company or proceed with our own Synder Books.

Note 1: if you are a QuickBooks Desktop user, check out this video tutorial to learn How to connect and sync data into QuickBooks Desktop.

Note 2: check out this guide if you would like to integrate QuickBooks Online or Xero.

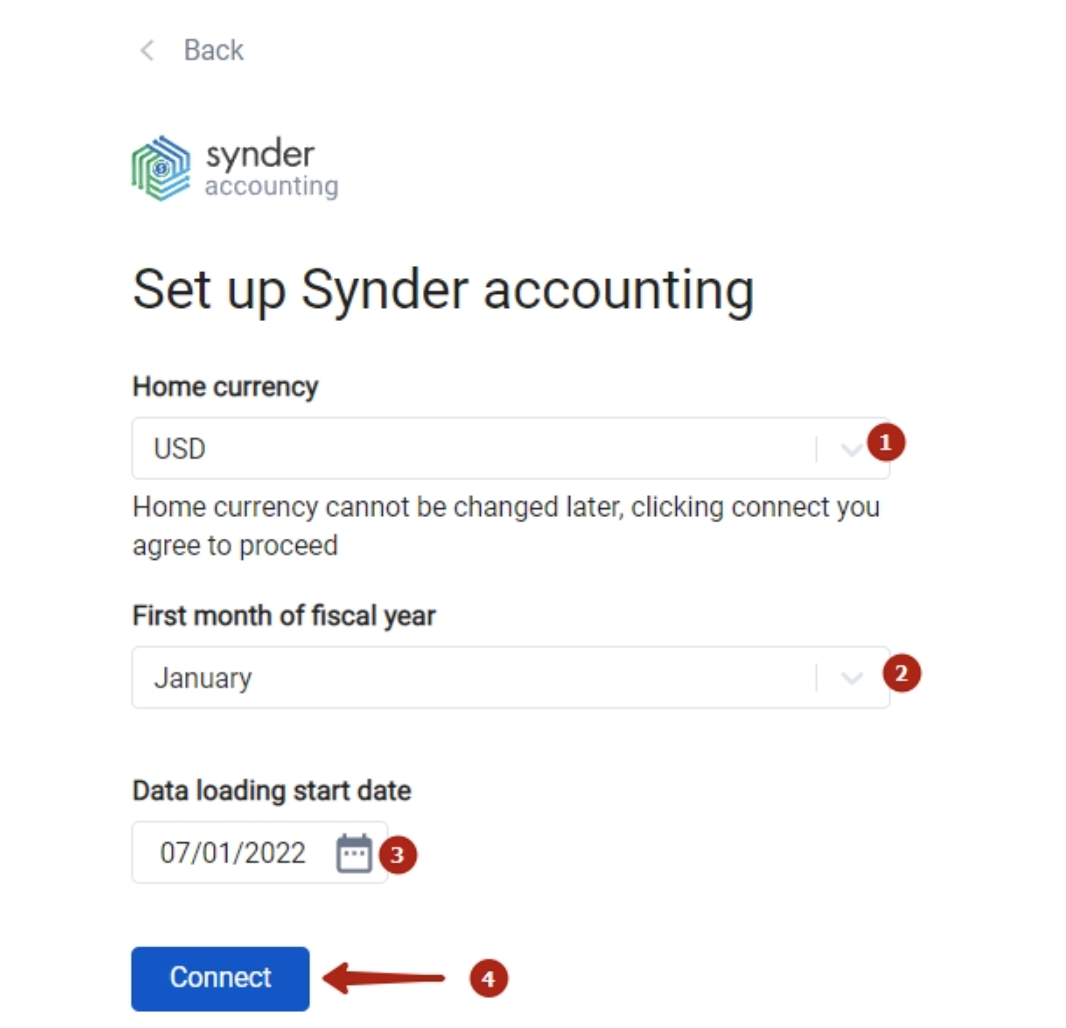

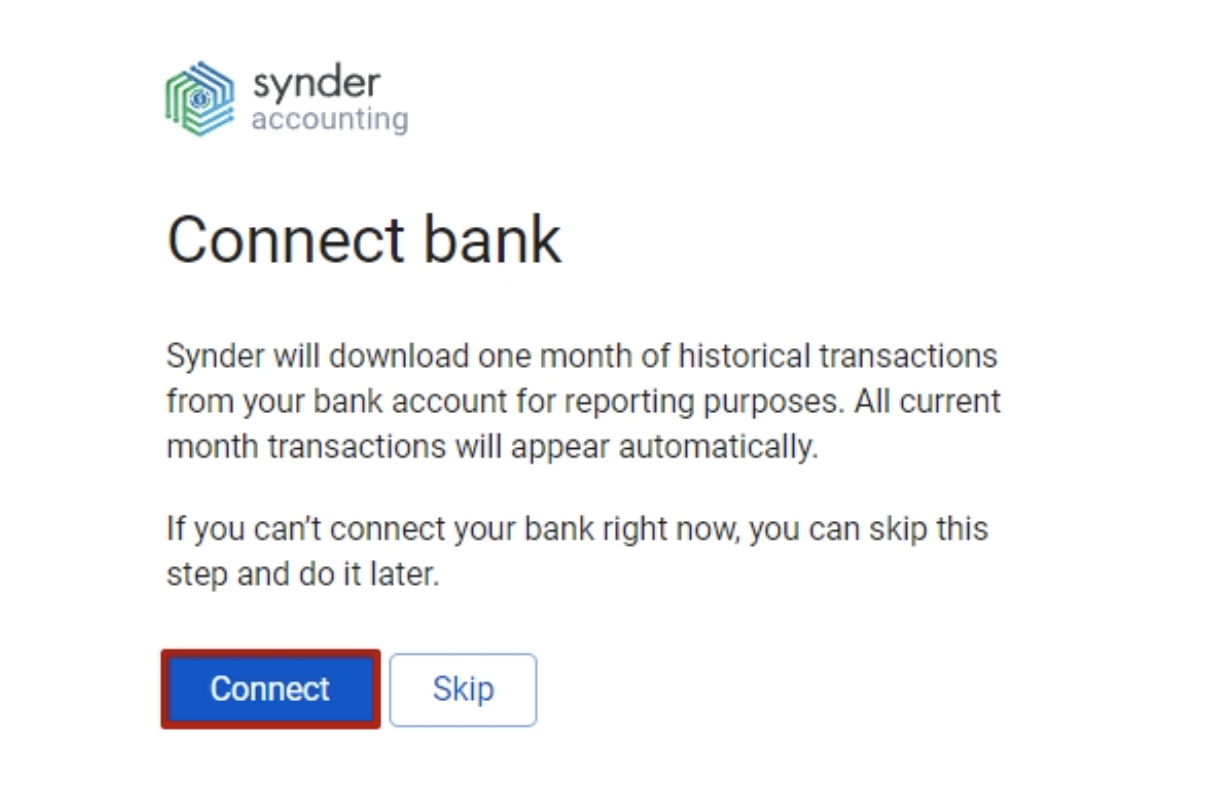

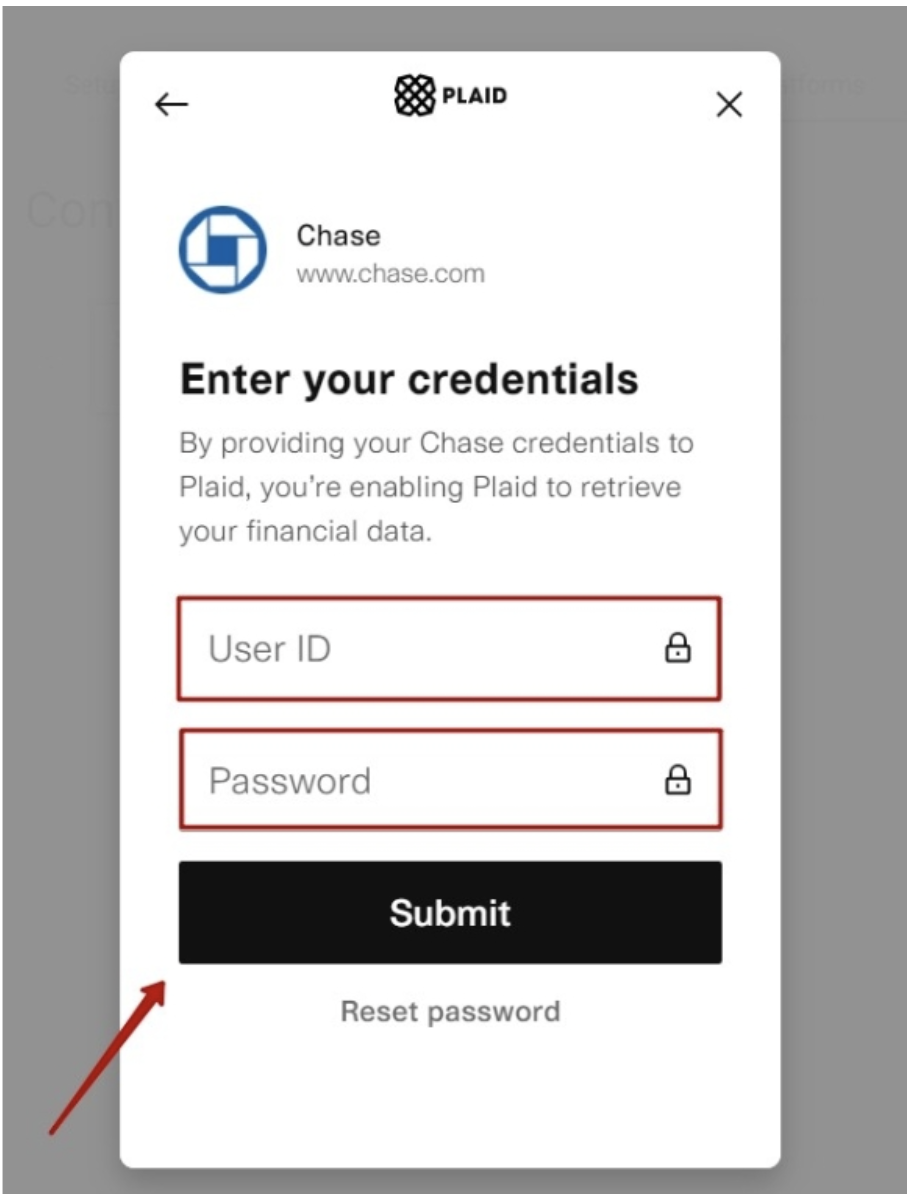

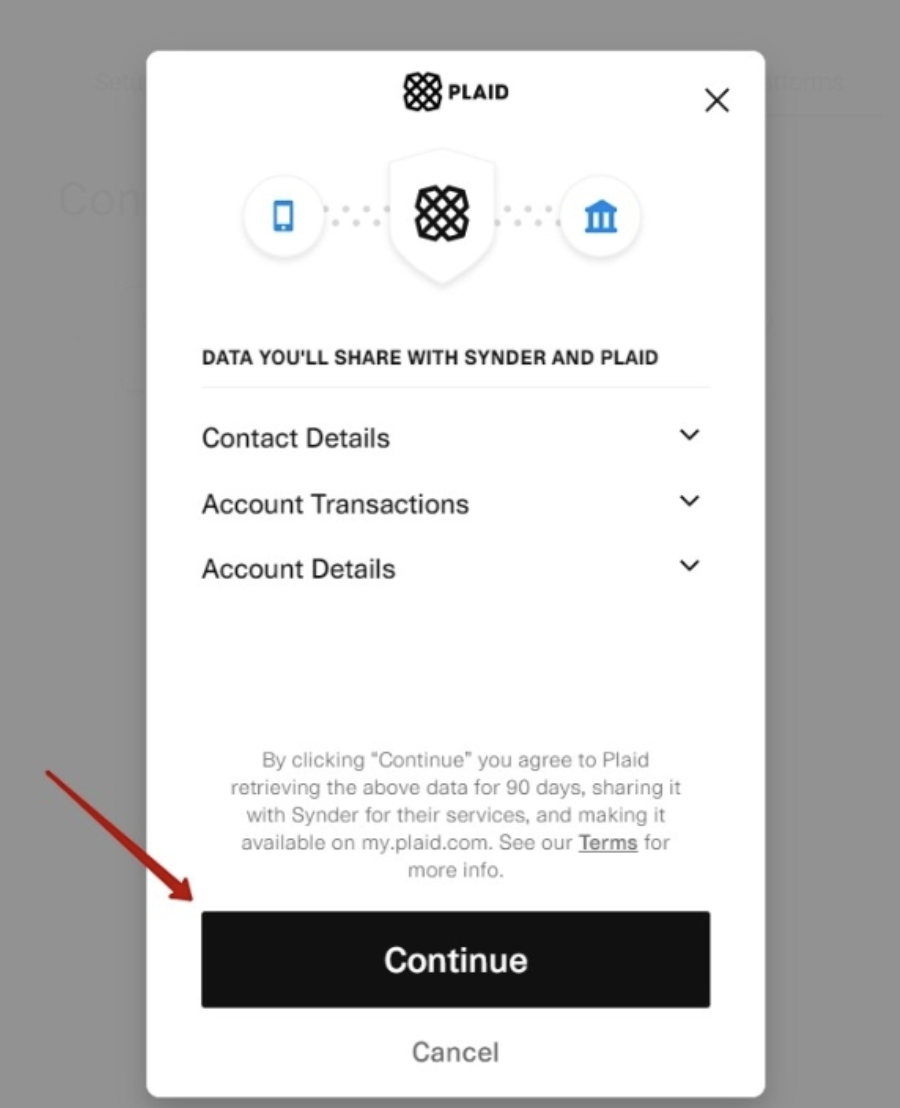

If you’re going to connect Synder Books, follow the steps on the screen to grant permission to the system

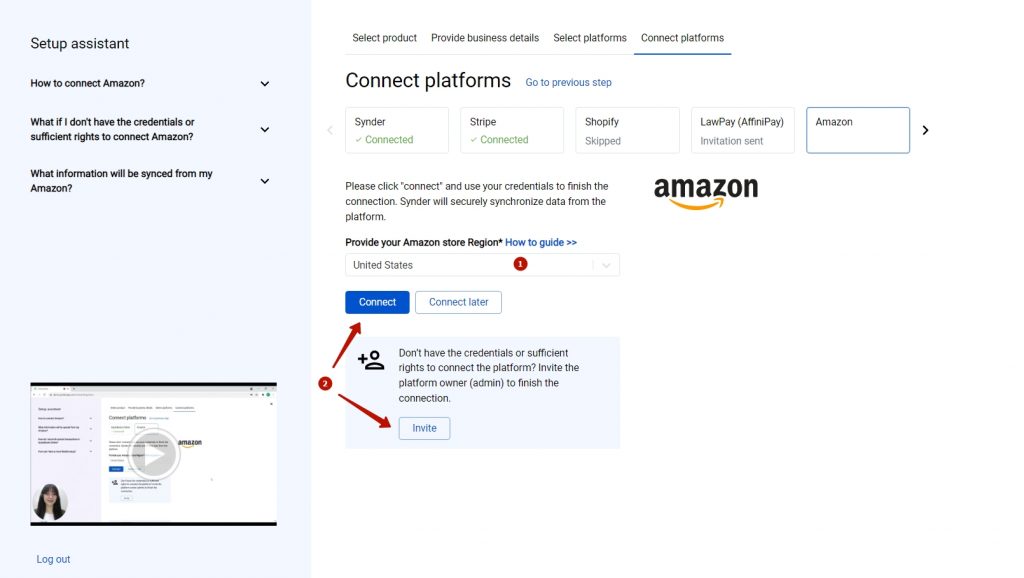

5. Connect your Amazon store

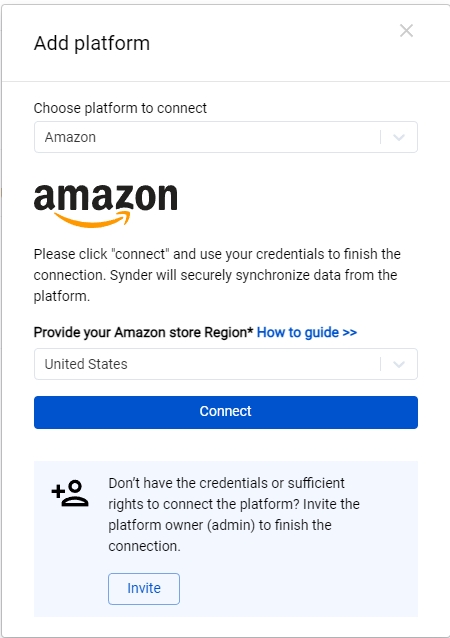

Almost there! To complete the setup, you just need to connect your Amazon and other sales platforms to Synder. You can integrate them one by one: just hit the Connect button (if you are an admin) or Invite (to invite the account owner).

To connect Amazon, provide your store region and click on Connect.

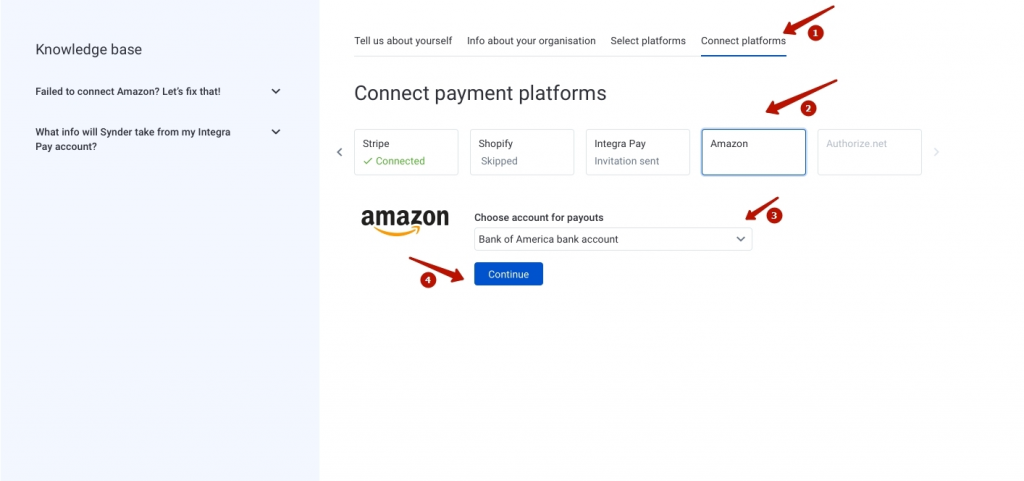

6. Set up the Amazon integration

To complete the setup for the Amazon integration, choose an account for payouts (usually, your Checking account) that will allow smooth reconciliation of your Amazon transactions in one click.

Bravo, you have set up the integration between Amazon and Synder! If you feel like some adjustments are necessary, you can manage that in Synder settings. Open them on the left menu → hit the Configure button under your Amazon platform. If you need to fill in gaps with missing data after the sync into your QuickBooks Online, like applying classes and locations to transactions, the Smart Rules feature will be of great service. Now, you can customize your Synder according to your needs.

Connect Amazon to an already existing account

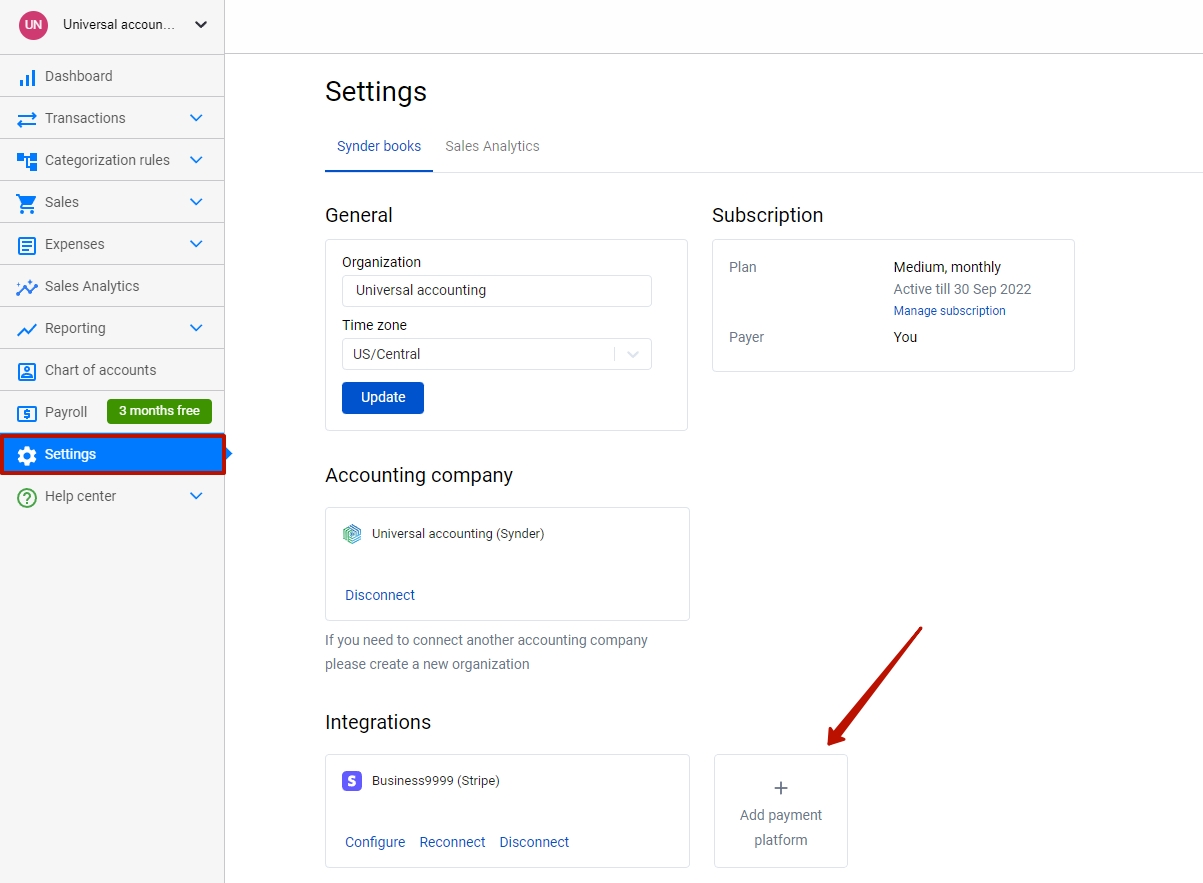

If you already have a Synder account and would like to integrate one more Amazon store follow the steps below:

- Select Organization needed at the top left.

- Go to Settings on the left menu.

- Click on the Add payment platform button.

- Select Amazon from the drop-down menu → select the Amazon store region → hit the Connect button.

Tips and tricks on Amazon integration

Note 1: Importing historical transactions from Amazon, please, note that you can not import more than 6 months – 1 year of historical sales and 2 years of historical payouts due to the API limitation (API is like a language apps use to talk with each other). On a trial, you can go 1 month back to import your historical data and try the software.

Note 2: Due to agreements with specific states in the USA, Amazon collects taxes on your behalf. However, these taxes are still to be accounted for in your books, as they are associated with your business. Synder will handle it properly and record all the details, including taxes. Check out this article on how taxes withheld by Amazon are processed with Synder for more details.

Note 3: A default “Amazon customer” will be auto-applied to all synced transactions from Amazon. Due to API restrictions, Synder cannot transfer Amazon customers’ details at the moment.

Note 4: Synder is able to apply classes to your expenses so that you don’t have to do that manually, thanks to its brand-new smart rules feature. Check out How to categorize Amazon Fees with Synder Smart rules and apply classes to Expenses.

Note 5: Amazon payouts can be synced into your accounting software 14 days after they were imported to Synder due to the Amazon API restriction (API is like a language apps use to talk with each other). During this time, the payouts will have the “Pending” status in Synder and then they will be synced automatically.

Note 6: If your Amazon account hasn’t been connected, you are likely to have selected the wrong location, i.e., a country name. To connect the correct Amazon account, please go to the Synder settings → click on Add payment platform → select Amazon and choose the correct location → click on Connect.

Congratulations! Your account is all set and ready to sync and import Amazon sales into Synder accounting, QuickBooks or Xero.

Get in touch with the Synder team via online chat, phone, or email with any questions you might have so far – we are always happy to help you!