What Is Withheld Tax?

Marketplace Facilitator Tax is a tax collected and remitted by Amazon, eBay, Etsy, PayPal and Walmart on your behalf, due to agreements with the specific states in the USA or other countries (Canada, etc.)

The trading platforms have been making agreements with states to collect and remit taxes on your behalf, thus lifting up this burden from your shoulders. However, these taxes are still to be accounted for in your books, as they are associated with your business.

Taxes withheld by marketplace are expenses to you (so you should either track them on expense account or decrease your liability)

How Does Synder Record Transactions with Tax Withheld by Amazon/eBay/PayPal/Etsy/Walmart?

The transactions that we receive from payment platforms contain tax which is supposed to be reflected in the books according to accountants, even if you don’t receive the amounts and are not liable to remit them to tax agencies. This is why Synder records tax amounts in the income part of a transaction (sales receipt/invoice) – and then also in the expense part of the transaction, along with the fee, thus effectively canceling them out.

To illustrate:

(total amount + tax amount) – (tax amount + fee) = total amount – fee.

So in your books, you will have an Invoice\Sales Receipt for the total amount with the tax inside. And you will have an Expense that shows in one line how much fee you have paid to the payment processor and in another line that the tax amount has been paid (and your business no longer owes it).

Learn more about how Synder handles sales tax and how to configure it in this helpful article.

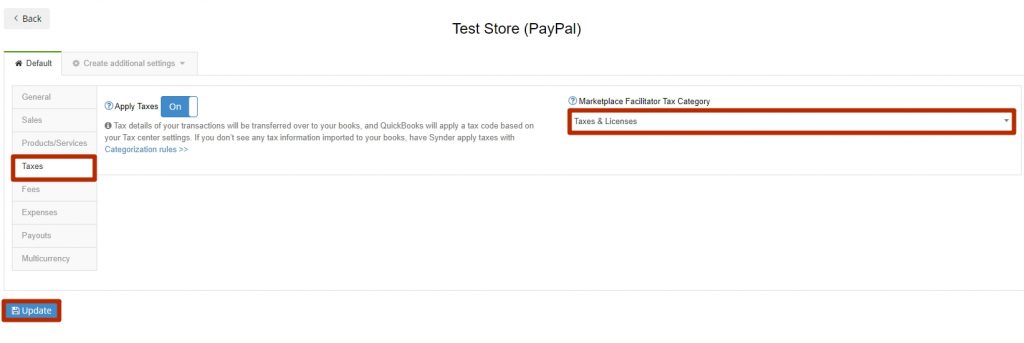

You can select the category needed for the tax portion of the expense in Taxes settings.

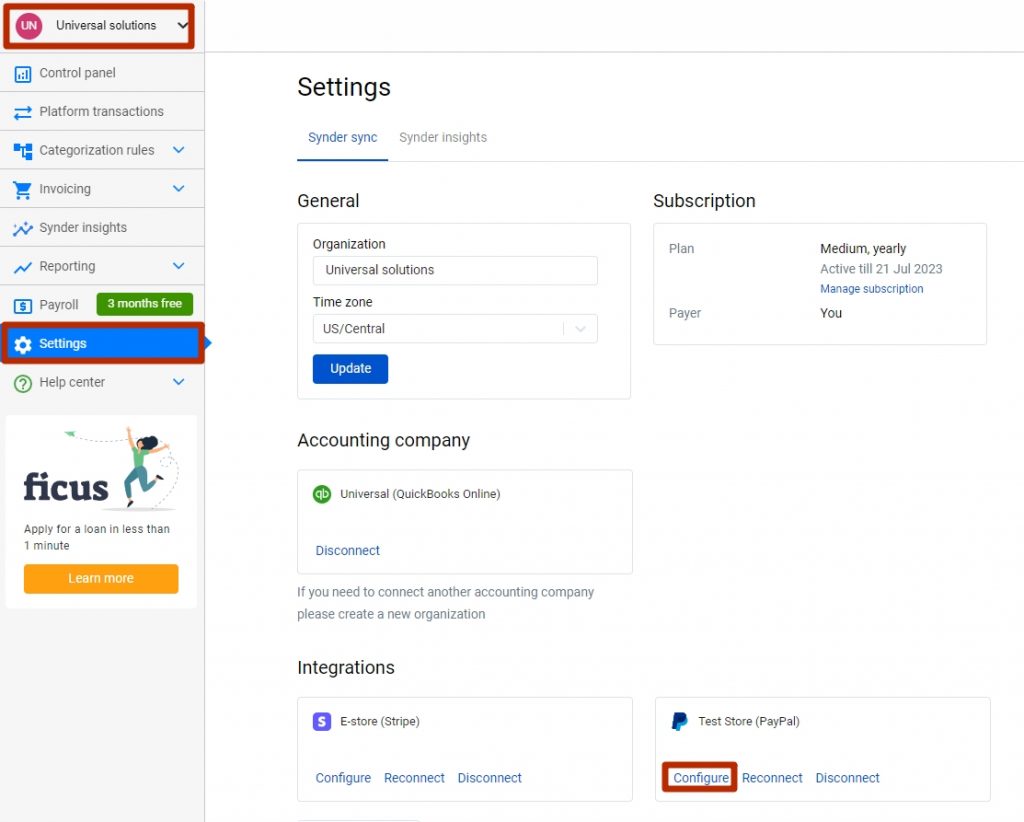

- Select the Organization needed at the top left of the page — > go to Settings on the left menu — > click on the Configure button under the payment platform needed.

- Go to the Taxes tab — > select the category needed under the “Marketplace Facilitator Tax Category” — > click on the Update button to save the changes.

How Should I Categorize Marketplace Facilitator Tax?

The shortest answer would be: ask your tax advisor, as this would guarantee that the answer will be correct for your bookkeeping flow. However, below are a few recommendations on how tax is handled in accounting.

Regularly a tax expense is a liability owed to a government agency within a given period. The payable amount is recognized on the balance sheet as a liability until the company settles the tax bill. However, if the tax has been paid out to the agency in charge by the facilitator it is an expense for you.

What category should I choose under the Marketplace Facilitator Tax dropdown in Synder?

Here are the two most popular options how our clients handle Marketplace Facilitator Tax in their books:

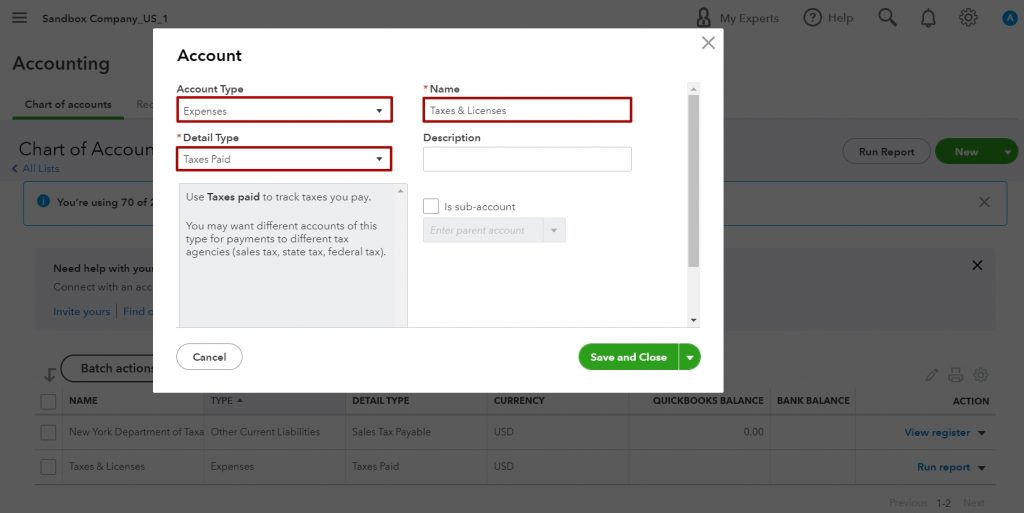

- An expense account for Taxes paid.

You can create a new Expense account in your books for taxes paid or select an existing one in the Marketplace Facilitator Tax dropdown in Synder settings:

Note: In this case the tax will be tracked both on the Sales Tax Payable account and Taxes Paid account, so the balance of the liability account won’t be reduced automatically.

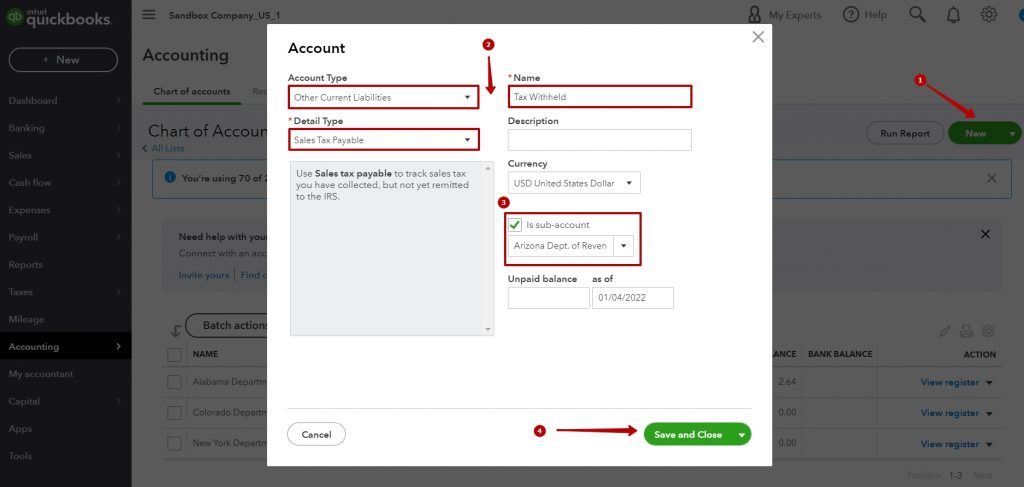

- A liability Sales Tax Payable subaccount.

As long as sales tax will be reflecting in your Sales Tax Payable account in your books during the synchronization (e.g. “Arizona Dept. of Revenue Payable” liability account) you might want to deduct the tax amount that has been already remitted by the marketplace from the same tax liability account.

QuickBooks in particular won’t let you use the Sales Tax Payable – Liability account type in expense lines, however, there is a way to achieve it.

You can create a sub-account under the Sales Tax Payable account and track your taxes due there. After that select that sub-account in Synder Marketplace Facilitator Tax settings.

In this case, QuickBooks reports for the parent tax liability account (e.g. “Arizona Dept. of Revenue Payable” account) as well as the Balance Sheet report will show balances reduced by the expense lines amounts.

Congratulations, you have set up the software to apply taxes to any synced Sales transaction!

If you have any other questions, please use the contacts specified in the footer of the page or, alternatively, initiate our in-app support chat. We will be more than happy to help.