Overview:

Where to find the settings for your Square integration

Default settings for different Square transactions

How to adjust your Square integration settings

Where to find the settings for your Square integration

After you connect Square online store to QuickBooks, Synder accounting or Xero, it is high time to adjust your integration settings. Synder software allows you to configure your workflow with flexible functionality. Let’s see how it works.

Where to find the settings for your Square integration

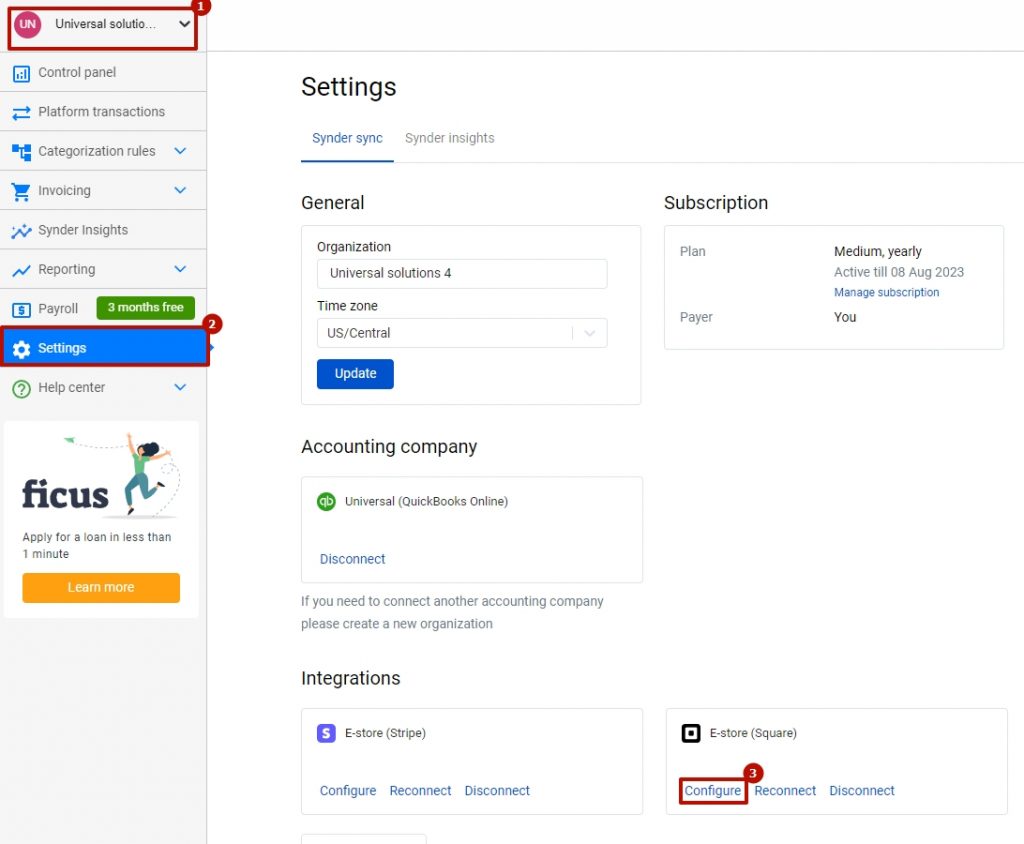

To start configuring settings for your Square online store integration with the accounting company, follow these instructions:

Select the corresponding Organization at the top right of the page – – > Press the Settings button on the left menu of Synder – – > If you have several payment platforms connected, find your Square account – – > Click on the Configure button.

Default settings for different Square transactions

Your Default settings will work for all types of transactions from your Square online store. Use the “Create additional settings” option only in case you would like to set different configurations for specific transactions (used rarely for very specific flows).

Synchronizing Square payments data

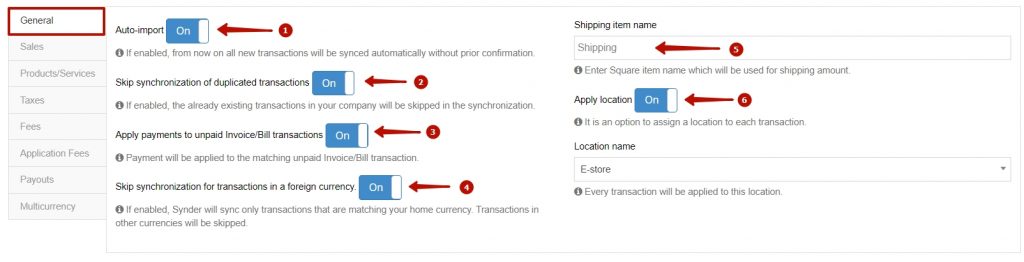

1. Auto-import

- when “ON”, the software automatically synchronizes Square payments data that comes into Synder after this setting has been enabled.

- when “OFF”, you can manually choose transactions to be synced.

Learn more about how to set up automatic synchronization of online payments in the auto-sync mode in Synder.

2. Skip synchronization for duplicated transactions

- when “ON”, transactions that already exist in your accounting company will not be synced again.

3. Apply payments to unpaid invoices / Bill transactions

- when “ON”, once the system encounters a Square payment that matches an unpaid invoice in your accounting system, it will be automatically applied to it.

Please note that for this setting to work properly, make sure the customer name matches on Square and Synder accounting/QuickBooks/Xero ends.

4. Skip synchronization for transactions in a foreign currency

- when “ON”, the system will synchronize Square transactions in your home currency only. Synchronization of payments in other currencies will be skipped by the software.

5. Shipping item name

- If the integration software encounters this name in one of your invoice line items, it will parse it as the shipping item and it will account for it accordingly.

6. Apply location

- when “ON”, you can select the location associated with the payment, this location will be applied to any synced transaction.

Please note, that tracking of the location should be enabled on the accounting software side.

How to adjust your Square integration settings

Connect Square to QuickBooks, Synder accounting or Xero accounting software and enjoy the flexibility of customizable Square integration settings. Here’s what you can configure.

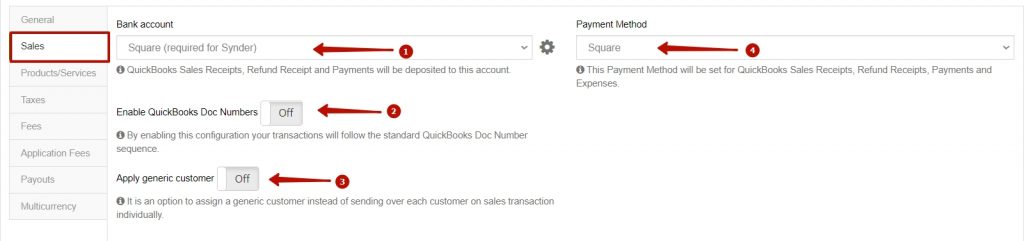

Square sales

- Bank account: a buffer account in QuickBooks where Square sales receipts, refund receipts, Square fees, Square taxes, and other payment data will be deposited. In case you do not have an account with “Square” in its name, it will be auto-created in your Chart of Accounts with the name “Square (required for Synder)”.

- Enable QuickBooks Doc Numbers: by enabling this configuration your transactions will follow the standard QuickBooks Doc Number sequence.

- Apply generic customer: assigns a generic customer name to all of your transactions. Click on “Select a name”. Choose from existing ones or type in a custom name.

- Payment Method: choose a payment method (cash, check, credit card, or Square) that will be set for QuickBooks sales receipts, refund receipts, payments, and expenses.

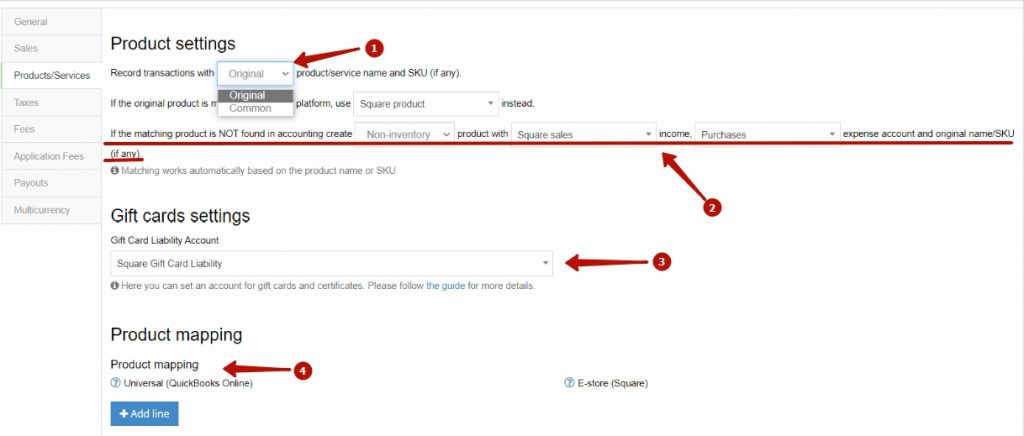

Square products and services

- In the Product settings, you may select whether you would like to record transactions with an original product/service name and SKU (if any) or assign the common name. If the Original option is selected, Synder will either create a product/SKU if it doesn’t exist or match it to the existing one. If the Common product is enabled, Synder will assign a generic product to all of your transactions (you may either select an existing name from your accounting company or type in a new one).

- If the matching product doesn’t exist in your accounting company, Synder will create it and assign either the non-inventory or service type to it (you may select which one you would like to apply) and will apply the income and expense accounts you have selected in the settings.

- Gift Card Liability Account: choose an account for gift cards and certificates. Click here for more info about accounting for Square Gift Card sales.

- Product mapping: Synder is able to identify existing products in your accounting company and apply them to transactions. If product names in your Square online store and the accounting software don’t match for 100%, fill in the product names from your payment platform in the right field to map them to the product names from your QuickBooks account. Check out an additional guide about the product mapping feature.

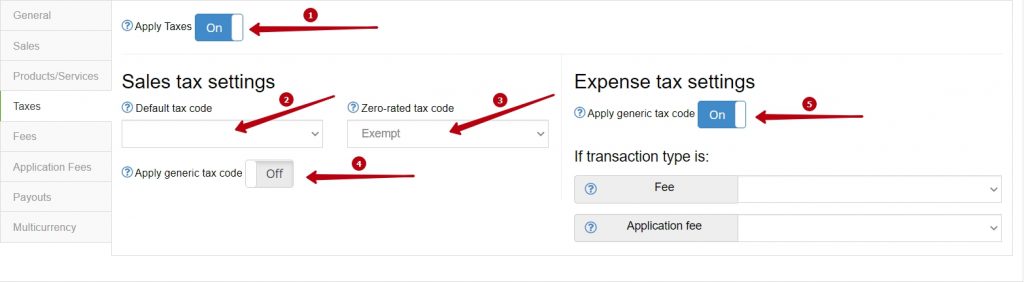

Square taxes

This tab can be different based on the country version of your accounting company and the taxation system there. So it is okay if you do not have some of the tax fields described, Synder integration software will automatically catch up with your Synder accounting, QuickBooks or Xero settings. Learn more how sales taxes work in Synder.

- Apply taxes: when “ON”, the software will search for a matching tax code and apply taxes to taxable on Square end transactions only. In case it is “OFF”, a tax amount will be included in the total sum.

- Sales tax settings. Default tax code: available if the Apply generic tax code setting is “OFF”. Used only in case the tax name was not found or if something doesn’t work properly.

- Sales tax settings. Zero-rated tax code: choose a zero-rated tax code Synder will apply to every item (line)/shipping line which doesn’t contain any other tax rate in the original transaction.

- Apply generic tax code: when “ON” the system will apply the tax you specified in the settings to any synced sales transaction (even if there is no tax code in the transaction on Square end).

- Expense tax settings. Apply generic tax code: when “ON”, the software will apply the tax rate you specify in the settings to both taxable and non-taxable Square transactions you sync with Synder.

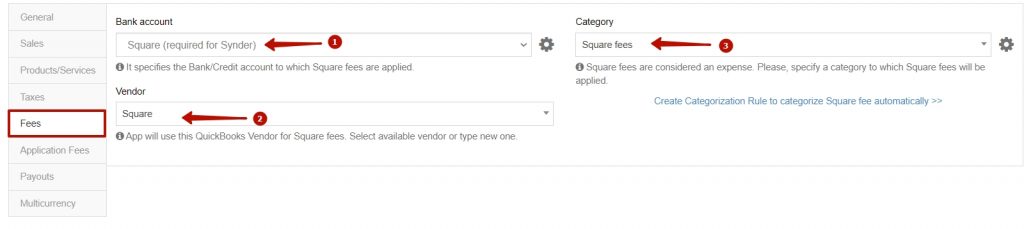

Square fees

- Bank account: this setting specifies the bank to which the Square fees are applied. We recommend using the same account as in Sales—Bank Account, highly recommended to use Square (required for Synder).

- Vendor: Synder will use this Vendor from your accounting company to store your Square fees. Select available, or type in a custom one.

- Category: this setting specifies the category to which the Square fees are applied, people like to use something like the “Bank Charges and Fees” category.

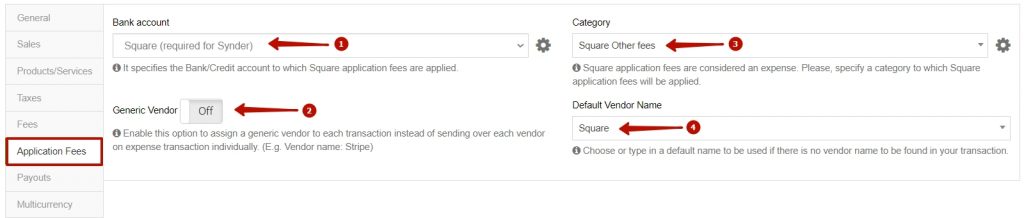

Application fees

- Bank account: this setting specifies the bank to which the application fees are applied. We recommend using the same account as in the Sales – Bank account.

- Generic Vendor: the software will use QuickBooks Vendor you select to store your application fees. Select available, or type in a custom one.

- Category: this setting specifies the category to which the application fees are applied.

- Default Vendor name: сhoose or type in a default name to be used if there is no vendor name to be found in your transaction.

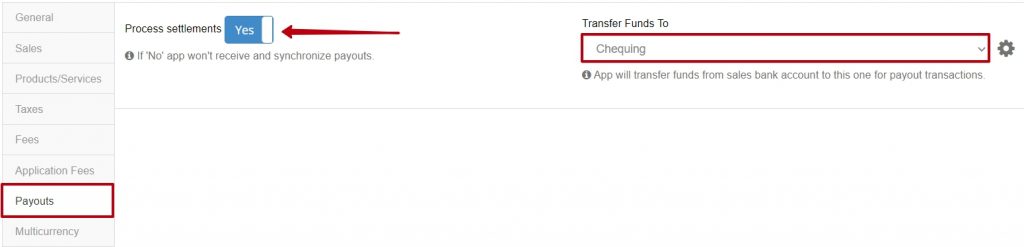

Square payouts

This tab allows you to track Settlements that Square deposits to your checking account—Square Payouts. Synder will record them in the Synder accounting, QuickBooks or Xero accounting company, allowing for a simple matching of your actual deposits from Square. Synder automation software will not duplicate your income, it will just create a matching record on the accounting system end for easy reconciliation in QuickBooks and Xero.

It is matched under For Review tab in the QuickBooks Banking tab.

- Process settlements: when “ON”, Synder will track and create transfers reflecting Square payouts to your checking account (from your “Square Bank Account” to your checking account).

- Transfer Funds To: сhoose the checking account that your Square funds are actually deposited to. For example, “Checking” or “Business Checking”.

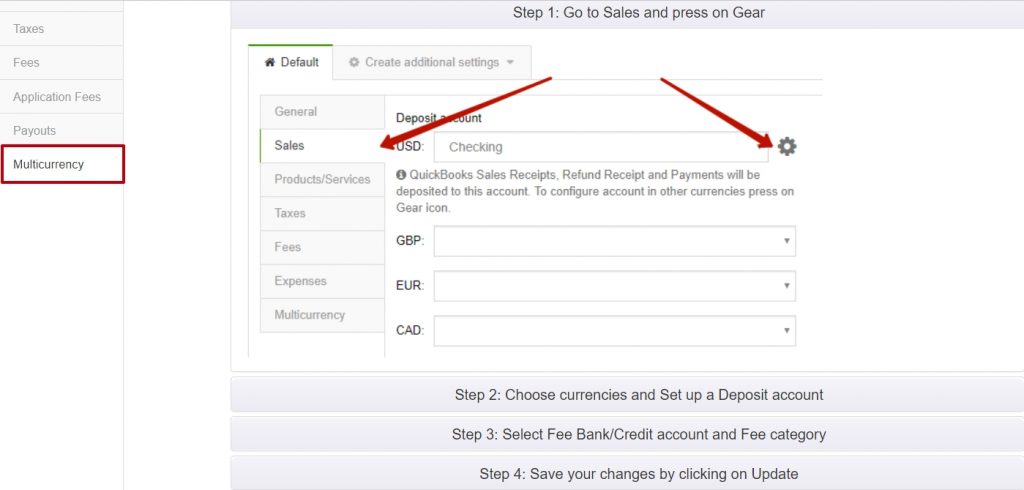

Multicurrency transactions

You can find how to customize Multiple Currencies here in the Multicurrency tab in the settings of your Square online store integration.

Get more details about how to enable multicurrency in QuickBooks.

If you haven’t found answers to your questions in this tutorial, ask our support team via online support chat.

Learn more about Square integrations that Synder offers::

Square QuickBooks integration

Square QuickBooks Desktop integration

Square Xero integration

Note: Synder can connect as many platforms as you need.