The first four months of every calendar year are the time when accountants are at their busiest. From January to April, there are few things that accountants do besides tax filing. This is what makes busy seasons so stressful for accountants.

Every year from January to April many hard-working accounting specialists are going to lose sleep, rest, and disturb their normal work-life balance till the very end of the tax season. It takes years of experience to get used to it, but it seems you’re never ready. If you’re a busy accountant seeking useful tips on how to survive this turbulent tax season and make your workflow as easy and stress-free as possible, you’ll find this article helpful.

TL;DR

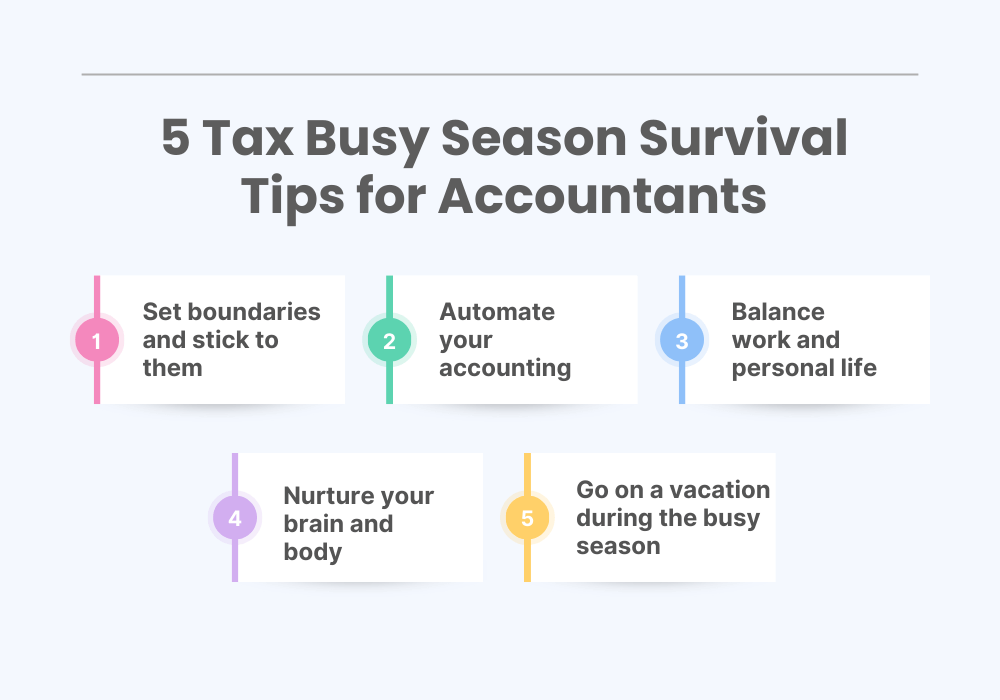

Accountants need to arm themselves with a handful of essential strategies to deal with the demands of the season:

- Set boundaries and stick to them;

- Automate your accounting;

- Balance work and personal life;

- Nurture your brain and body;

- Go on a vacation during the busy season.

Contents:

1. What is tax season like for accountants?

2. When is the busy season for tax accountants?

3. When is the busy season for an audit?

5. How many hours do accountants work during the busy season?

6. 5 tax busy season survival tips for accountants

What is tax season like for accountants?

Tax season can be one of the most stressful times for accountants and other accounting professionals. During this busy accounting season, accountants usually work long hours to meet tight deadlines while also ensuring clients’ confidentiality.

Accounting professionals have many paperwork responsibilities that they need to keep up with during the tax season (such as 1099s, W-2s, etc.). They must be organized, detail-oriented, and prepared for anything that may happen during this Jan-April tax filing season. Accountants need to know the tax laws inside out, as well as how to handle any potential problems that may arise.

When is the busy season for tax accountants?

The busy season for tax accountants typically takes place during the first quarter of each year running from January to April each year. This period corresponds with the time frame for individuals and businesses to prepare and file their annual tax returns.

The deadline for filing taxes in the United States, for example, is usually April 15th, making the weeks leading up to this date particularly busy for tax accountants.

When is the busy season for an audit?

The busy season for auditors generally occurs from January to March. This timing can vary depending on the fiscal year-end of their clients. Many companies have a December 31st year-end, leading auditors to be busiest in the following quarter as they work to review and finalize financial statements. However, for companies with different fiscal year-ends, audit busy seasons can occur at other times of the year.

Tax vs. audit busy season

Tax accountants and auditors’ peak times work share many similarities. However, they can be affected by the busy season accounting challenges differently.

Tax professionals

Tax accountants often work directly with individual clients or businesses to gather financial information, prepare tax returns, and ensure compliance with tax laws. The busy season requires frequent communication to collect documents, clarify information, and provide updates on tax return status.

Accountants who work in a tax practice need to be proactive in their communication, often setting expectations early regarding deadlines, required documentation, and potential delays. They may use emails, phone calls, and meetings to keep clients informed.

The primary challenge for tax professionals is managing a large volume of clients with similar deadlines, which can lead to high pressure to deliver accurate and timely work. Ensuring that clients provide necessary documentation on time and managing last-minute requests are significant hurdles. Building trust and rapport is crucial, as satisfied clients are likely to return each year.

Audit professionals

Auditors engage with clients to review their financial statements and assess compliance with accounting standards. Unlike tax professionals, auditors often work on-site at the client’s location for an extended period, which can span several weeks or months depending on the audit’s scope.

Communication during an audit involves regular updates on audit progress, findings, and any issues requiring resolution. Auditors must coordinate with various departments within a client’s organization, requiring clear and effective communication channels.

For auditors, the busy season involves balancing multiple audits, each with its own set of deadlines. Auditors face the challenge of gathering all necessary information from different parts of the client’s business, which may not always prioritize the audit process. Maintaining a positive relationship with the client while conducting a thorough and independent audit requires tact and professionalism.

Is bookkeeping a stressful job?

Bookkeeping can be a bit like juggling. For some people, keeping all those balls in the air is thrilling and fun. For others, it might feel a bit overwhelming at times. As a bookkeeper, you’re in charge of keeping track of all the money that comes in and goes out of a business. This helps businesses know how they’re doing financially and ensure they’re paying their taxes correctly. And this exact element of responsibility, in itself, can add a layer of stress.

There are also other reasons. Tax season is surely a stressful time for bookkeepers but that’s only a portion of the year. Also, if deadlines make you sweat, or if you’re juggling lots of clients with lots of different needs, there could be moments when it feels like too much to handle.

The good news is that with the right tools and some good planning, a lot of the potential stress can be managed, making bookkeeping a rewarding job for many people.

How many hours do accountants work during the busy season?

When asking accountants on Quora, Reddit, or any other forum how much time they work during the tax season or busy season, you’ll hardly hear about reasonable hours of work. And probably a lot of them will say that Saturday has become their working day as well.

The working hours during the accounting busy season are typically somewhat between 50 and 80 hours per week. However, the number of hours varies depending on the complexity of the client’s taxes and their workload.

Join accountants who’ve mastered high volume transactions. Dive in to discover their strategies!

5 tax busy season survival tips for accountants

Busy season tip #1. Set your boundaries and stick to them

Executing time management strategies may be difficult for an accountant when the urgency of tax season comes into play. Every one of your clients is pulling you in their direction. But to meet all the needs and requests of your customers would probably require a 24/7 work week.

In no time, an accountant or a CPA (Certified Public Accountant) turns into a busy bee, spending 20-plus hours a week answering requests for legal advice on tax season preparation and deductions from the owners of small businesses, who are likely to be past their filing deadlines. But does overworking mean high performance? Not at all.

More often than not, it means burnout and frustration. And it’s neither in the interests of your clients, nor your own. When you try to cater to everyone’s needs, you can’t perform well during the tax filing season. Will your clients be satisfied with loosely done books, auditing, and tax preparation in the end? That’s why the busy season is all about setting boundaries.

Create a schedule for essential accounting work and requests

For each tax season, do your planning and stick to it. Schedule time for different activities as precisely as you possibly can — meetings, incoming calls, emails, and message responses. Give your clients detailed information about when, how, and on what topic they can get in touch with you. So apart from scheduling the essential elements of your job, allocate some resources to the request-time of your clients, and stick to it.

Take your time to do the things you have to do without getting distracted by non-prioritized demands, and don’t feel guilty about it.

Get comfortable with saying ‘no’

There must be time for accounting and time for life. By setting boundaries, you alleviate the pressure of meeting unrealistic expectations. Don’t be afraid of clients getting frustrated. Let your clients know what assistance services they can expect from you. It’s much better than making promises you can’t actually fulfill. It builds trust. If you perform your job to the discussed expectations, your clients will always stay satisfied.

There’s nothing rude about boundaries. The positive effect of your mindful auditing and accurate accounting protects your resources and even your client’s tax deductions. Set up voicemail and the auto-reply function on your emails with a polite notification when you’re going to be back. Working with your clients doesn’t mean having a ban on saying no. It means giving their businesses the best professional help you can give them during the busy season.

Busy season tip #2. Free more time by automating your accounting

If you haven’t introduced yourself to cloud-based programs and accounting automation before the upcoming tax season, you might be missing out. And what’s more, doing the manual work only eats away at your precious time.

The world is changing, and your clients’ accounting demands are growing. How long will you be able to keep your head above water? It’s high time you got rid of manual records and ensured the correct synchronization of data, especially during this busy tax filing season.

Explore how automation can ease your load

Many business owners today are implementing accounting automation solutions, which is a great option to keep your financial records accurate and secure. But it’s not all a modern business needs from an accounting system.

In a few years, the complexity of real-time ecommerce transactions will make it impossible to keep reconciling bank statements manually. We need to accept the necessity of shifting all mundane tasks to accounting automation software.

When filing for the tax season, there’s more need for trustworthy accounts receivable solutions than ever before. But if you want to collect all the data from selling platforms or payment providers correctly, you won’t be able to do it in an error-proof way through the direct integration of payment platforms to the accounting system. Luckily, accounting software solutions make the whole process easier. One of these software solutions is Synder Sync.

Discover how Synder streamlines ecommerce accounting

Synder Sync – a helper for both busy accountants and business owners – is a fully functional accounting receivable solution that provides real-time data transfers from all the payment processors into the accounting software. This automation tool fills all the missing gaps and spots ‘lost’ fees, sales taxes, and shipping costs to provide its users with the most accurate and detailed reports. No more mess with transactions during the tax filing season.

As an accountant working with a business owner, you can share the account and always have access to the ongoing transactions sync from all the connected platforms.

Synder Sync’s vast integration options

Ecommerce platforms: Shopify, Amazon, eBay, Etsy, BigCommerce, WooCommerce, etc. (check out for more on our integration page)

Payment providers: Stripe, PayPal, Square, Afterpay, Brex, etc. (check out for more on our integration page)

Now, as Synder Sync does all the work in the background, get yourself a cup of coffee, and let’s proceed with some more tips on how to make this busy season feel even better.

Book a seat at our Weekly Public Demo to find out how Synder can help your accounting firm.

Busy season tip #3. Balance work and personal life while you’re busy accounting

Tax season is all about balancing work, family, and accounting reporting.

Explain to your friends and family that the busy season demands more of your time but it doesn’t mean that you want to be left alone. In fact, you need more attention, care, and understanding from your close ones than ever.

Discuss the possibilities of rearranging your usual activities. Don’t be afraid to ask for help when you need it. Even if it’s small things like taking your dog for a walk. Any help will be priceless for you in the thick of the busy tax filing season.

You’ll find it life-saving to schedule daily and weekly family meetings or adjust the ones that you already have to fit your current work and life pace. Don’t sacrifice completely on little (but essential) life pleasures such as a family dinner or an evening walk together. Your sacrifice will become theirs, too. That’s why maintaining a work-life balance should remain a top priority during the busy season. Even if it’s 15 minutes instead of an hour, it’s the nourishing time we all need, no matter how busy we are.

Busy season tip #4. Nurture your brain and body for better accounting practice

Normally, we don’t question basic things like sound sleep and stable nutrition. But during three and a half months of the restless tax season, many things might start to slip away.

The majority of accountants claim to be working as much as 56 hours a week during the tax filing season — weekends included, some of them raising the bar as high as 90. When stress is at the risk level, even the most basic self-care needs become neglected. It’ll inevitably affect the quality of professional services you perform.

That’s why you’ll have to force yourself to keep an eye on your health. Take a mental break from time to time and stretch your muscles. You might even have to set a notification to eat! Things like that don’t seem crazy during the tax season at all.

Remind yourself to nurture your bodily needs and put them in your planner. Want to stay focused for the whole next day? Get some good sleep. That’s the best advice you can ever follow.

There are many simple apps that can make your life easier during the tax season. Search for local healthy food delivery, 5-minute meditation guides, eye-relaxation exercises, and a mood tracker, and build them into your daily workflow.

Busy season tip #5. Go on a vacation amidst the busy tax season

There’s a misbelief that accounting professionals aren’t supposed to take any vacations at the peak of the tax filing season. However, many accountants do prefer to take a weekend or two off and get carried away to a place where nothing resembles reconciliation statements or tax filing forms.

Still hesitant about the idea? Consider this. The tax season is a marathon for the accountants. Spending 90% of your time on revising books, tax planning, auditing, and preparing financial reports will inevitably drain your brain and body at some point. Many feel like breaking right in the middle of this marathon — no chance of achieving work-life balance when strained to the limits.

Clearly, you’ll need a second wind, so why not go on a vacation? If booking a flight far away sounds too adventurous, carry yourself to the nearest calm place. Have a stroll on a beach, take a long hike in the mountains, go cycling, or sightseeing – whatever strikes your mood. Let yourself rest for a small period of time from the endless tax season race.

A short break won’t hurt your business but will save your sanity. Getting a brief recharge may be surprisingly helpful for boosting your energy — a bit like a power nap.

Want to find out more about accounting career paths? Read our article and learn how to become a freelance accountant.

Conclusion: How to prepare for the busy season accounting challenges

Tax season is far more demanding than the rest of the year for every practicing accountant. But surviving the bustling tax season is all about resource management. And in this context, you are the resource that you need to manage with care and attention.

Don’t ignore automation and help your business with any technology enhancement that facilitates accounting processes. Utilize software solutions for easy accounting like Synder. Prioritize time management with clients and don’t hesitate to set professional boundaries, where they’re necessary. And of course, remember to take care of yourself and spend quality time with your loved ones to maintain a healthy work-life balance during the tax filing season.

Keep in mind the long-term perspective. Remind yourself that this too shall pass, it’s just a tax season, something temporary. Once you make it through it, your life will return to its regular rhythm.

Find out how to tackle common bookkeeping challenges of ecommerce businesses. Learn how to efficiently manage high-volume transactions.

Share your experience

Whether you’re navigating tax season, wrapping up audit engagements, or managing financial reporting, we all have our unique strategies and stories of resilience.

What are your top tips for managing stress and maintaining productivity during the busy season? How do you balance work and personal life when the workload increases? Have you discovered any tools or practices that significantly improve your efficiency? Can you share a memorable experience where you successfully navigated a particularly tough busy season?

Your insights can be a valuable resource for fellow accountants, providing them with new strategies to tackle their busy season challenges. Share your stories and tips in the comments below to help build a supportive community of accounting professionals.

I love this post. The thing I like in your posts is that everything is in a detailed and learning manner.

I appreciated you pointing out that taxation services need to keep up during the tax season. My friend wants their tax season to be smooth. I should advise him to turn to a taxation service for proper guidance.

I liked how this post shared that maintaining a work-life balance is crucial even during tax season. My friend wants their tax season to be smooth. I should advise him to hire a tax accountant with years of experience in the field.