As businesses strive for greater efficiency and accuracy in their operations, the convergence of industry giants Amazon and QuickBooks Online presents a groundbreaking solution. Their collaboration aims to bridge the gap between sales and financial management, offering a more streamlined approach for today’s savvy entrepreneurs.

Amazon, with its staggering global reach, caters to millions of sellers and even more consumers. It has firmly established itself as the epicenter of online shopping, boasting vast and varied sales data. On the other side, we have QuickBooks Online, Intuit’s flagship accounting software, which has transformed the way businesses approach bookkeeping, offering cloud-based solutions that prioritize usability and real-time access.

In this comprehensive guide, we’ll explore the nuts and bolts of Amazon QuickBooks Online integration via Synder. From setting up and navigating the interface to understanding the profound benefits it offers, we’ve got you covered.

Contents:

1. Synder benefits: Reasons to implement Amazon + QuickBooks Online integration

2. How to set up the QuickBooks Amazon integration via Synder

3. Key features of the QuickBooks Amazon integration via Synder

4. Amazon QuickBooks integration FAQ

Synder benefits: Reasons to implement Amazon + QuickBooks Online integration

If you’re on the hunt for innovative and efficient methods to bridge Amazon with QuickBooks Online, then Synder’s capabilities are well worth your attention. Here are some benefits Synder provides its users with.

Withheld tax tracking

Being an Amazon seller means dealing with marketplace Facilitator Tax, which is a tax collected and remitted by Amazon on your behalf. However, these taxes are still to be accounted for in your books – you should either track them on an expense account or decrease your liability.

Synder records tax amounts in the income part of a transaction (Sales Receipt/Invoice) and then also in the expense part along with the fees, thus effectively canceling them out.

To learn more about how Synder records Amazon taxes, check out Synder’s use case – Managing Sales Taxes: How Synder Simplifies Amazon Sales Tax Collection.

Connection of additional sales channels and/or payment platforms

When tracking the revenue, it’s important to do all the records accurately. And that’s what Synder does even when you have payment gateways besides Amazon Pay, such as Stripe, PayPal, etc. All you need is to connect these platforms so the software will be able to record the transactions going through these platforms right into your books. Moreover, you can connect additional sales channels to track the business performance across all platforms.

Per Transaction or Daily Summary sync options

Synder provides Amazon sellers with an option of either syncing transactions per platform or posting a single record per connected platform to the books with all sales, fees, refunds, taxes, and discounts on a daily basis. The Per Transaction mode will suit you if you need details of your Amazon transactions to have a more comprehensive reporting. The journal entries from daily summaries, although less detailed, are more suitable for recording a large number of transactions.

If an additional payment platform is connected, you’ll get 2 journal entries reflecting the records from Amazon and the connected payment gateway.

Note: No customer data is transferred to your QuickBooks when choosing the Daily Summary sync.

Data security

Synder is SOC 2 Type 2 Certified and provides the highest level of security and compliance for your financial data. With advanced encryption and secure connection, you can be assured that the data transferred between the platforms, Amazon and QuickBooks in this case, remains confidential and protected.

Detailed reporting

By recording the data that is important for accounting and bookkeeping, you’ll be able to generate detailed and accurate P&L and Balance Sheet reports. Synder covers all income and expense details stored from Amazon and Amazon Pay or any other connected payment gateway (plus, an additional sales channel, if it’s connected to Synder as well).

24/7 support

Synder support specialists are available via chat and email 24/7 and ready to guide you through the whole Amazon QuickBooks Online integration onboarding process whenever you need it. If you want to see the actual workflow, Synder experts hold weekly product Demo sessions, where you’ll see how the software works from the inside.

How to set up the QuickBooks Amazon integration via Synder

Now let’s create your account by following these step by step instructions below.

Note 1: You need an Amazon plan with API access to be able to connect Amazon to Synder.

Note 2: Synder doesn’t support Amazon Vendor Central.

1. Create an account

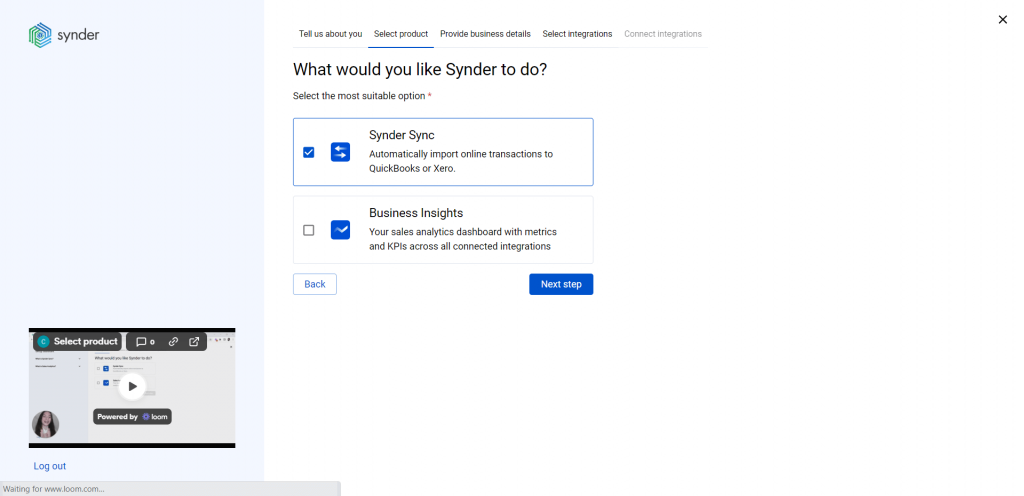

Firstly, you need to choose the product you want to utilize. Synder provides you with two options: Synder Sync and Synder Insights.

- Synder Sync – an actual connector between your sales channels and QuickBooks Online;

- Synder Insights – an analytical tool that allows you to track the most important metrics of your ecommerce business.

Note: You can select either one or both products.

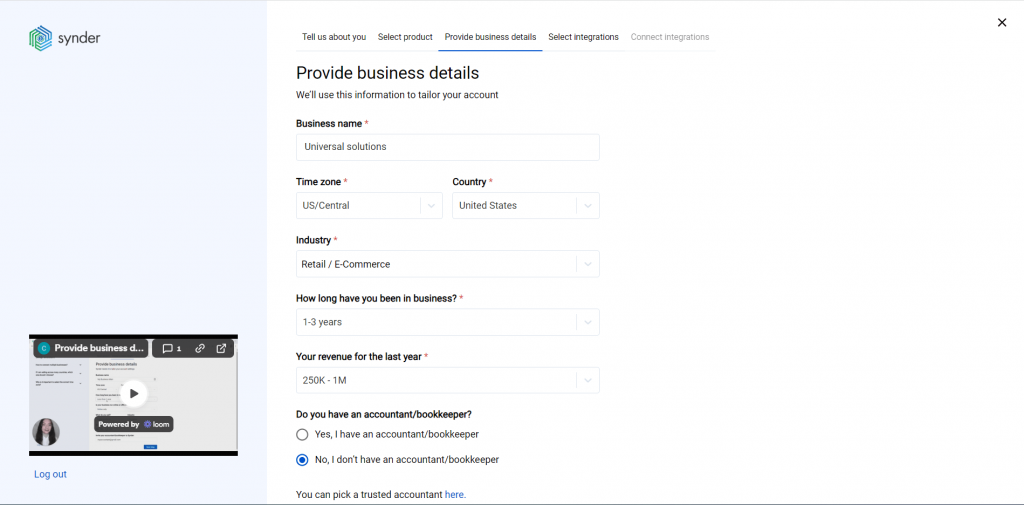

2. Set up the organization

Fill out the necessary organization information, such as the name of the organization, time zone, country, industry and how long the business has been on the market.

This info will help us understand your needs better and provide you with a personalized help and support.

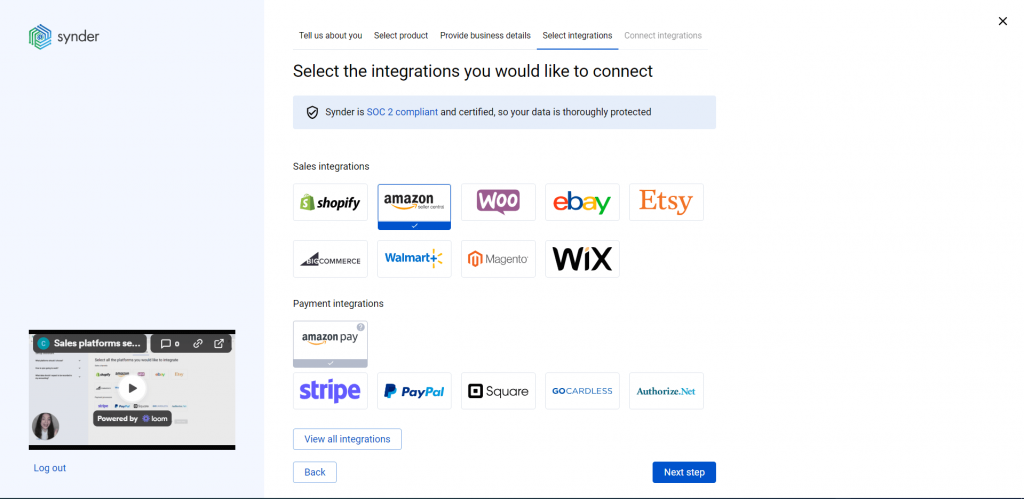

3. Select Amazon as your platform

Choose Amazon for the sales integration.

If your Amazon store accepts payments via payment gateways other than Amazon Pay, it’s strongly recommended to connect these payment platforms to Synder as well. By doing so, you’ll get flawless records of sales, fees, refunds, and payouts from the connected payment gateway with additional data provided by Amazon orders.

Note: Click ‘View all integrations’ to see all the platforms available for integration.

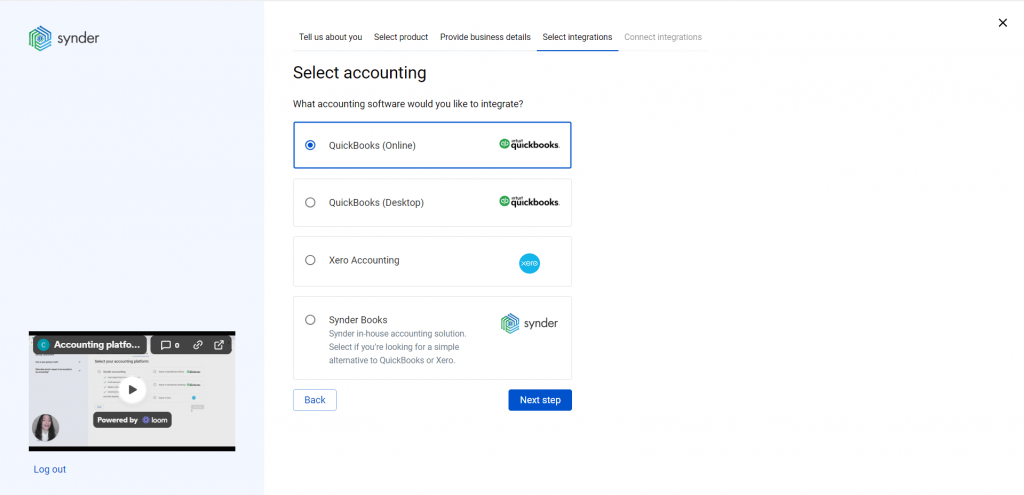

4. Select QuickBooks Online among accounting software

Choose QuickBooks Online among the provided options.

Synder is also available for integrations with QuickBooks Desktop, Xero and its own accounting software – Synder Books.

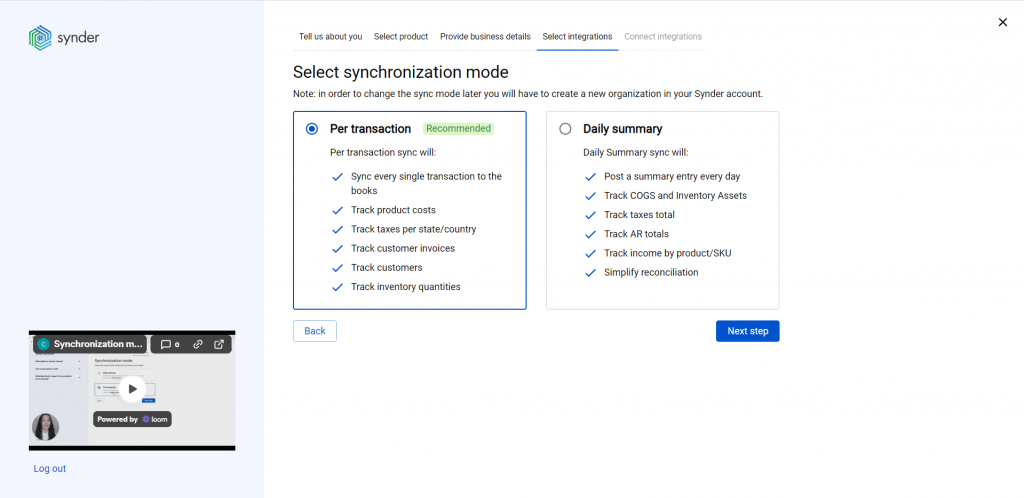

5. Choose the sync mode

Synder provides two options for transaction synchronization: per transaction or on a daily basis. Choose the one that suits you best.

Don’t know which one to choose? Check out our guide to learn more about the workflow and benefits of both modes.

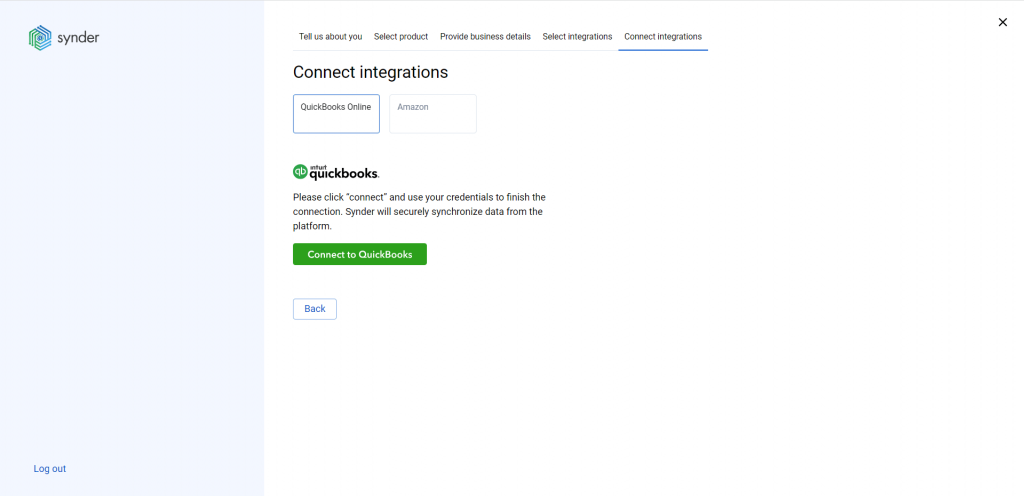

6. Connect platforms

At this step, you’ll need to connect your QuickBooks and Amazon accounts. You can simply click the “Connect” button (if you’re an admin) or “Invite” to send the link to the business owner (if you’re an accountant or a bookkeeper). When connecting Amazon, you need to select the region of your account for the connection process to go smoothly. Each region has a different MWS token.

You’ll also need your Seller ID.

To complete the setup, choose a payout account (usually your Checking account) that will prepare your books for error-free reconciliation.

When both accounts are connected, Synder will finalize the process and synchronize the most recent transactions to your books.

If you already have a Synder account and want to add Amazon, check out Synder’s guide on how to connect Amazon to an already existing account.

And that’s it! Now your Synder account is ready to sync your Amazon sales. Keep in mind that you need to customize the Synder account to your needs so make sure all the important accounting and bookkeeping options are enabled in the settings.

Key features of the QuickBooks Amazon integration via Synder

Instant synchronization and historical data import

Get an instant record of the ongoing Amazon sales right into QuickBooks as soon as they happen to have a real-time reflection of your finances. Synder takes all the details that may affect your bookkeeping or accounting so the final reports will contain all the necessary information about income and expenses. The Amazon sales will be recorded based on the synchronization mode you’ve chosen during onboarding: per transaction or daily bundles.

To store additional financial data from the transaction that went through a platform other than Amazon Pay, you’ll have to connect the payment platform in use so that Synder is able to recognize all transactions and store them successfully.

Note: You can’t import more than 1 year of historical sales and 2 years of historical payouts due to the API limitations.

Error-free multi-channel reconciliation

Pre-check all the transactions recorded to QuickBooks from all the platforms connected to Synder, both sales channels and payment gateways, to ease the actual reconciliation process. When a payout from a payment platform is recorded, it’s automatically reflected in your QuickBooks Online account (‘Bank feeds’ tab). This matching process helps decrease the discrepancy and get a zero difference between the two balances during the reconciliation process itself.

Payouts won’t duplicate your bank feed records.

Automated categorization and classification

To automate the categorization of products, assignment of classes and locations, sending out reminders, and completing missing data, simply create your personalized rules. Once these rules are in place and activated, Synder will automatically implement them for new transactions. All you need to do is to choose a specific trigger that’ll cause an action which is set by you as well. It can be a simple classification of products with a particular name or income/expense tracking per platform. You can also implement Synder’s pre-made templates and either utilize them unchanged or create your own based on the already created ones.

Check out how automated categorization works in practice – Categorization Of Financial Transactions: How Synder Helped To Categorize Expenses and Income.

Inventory tracking

Synder fetches items and SKUs from Amazon so when inventory and COGS tracking is set up, the software will be able to categorize the income by the product income accounts specified in your books. For businesses, this translates to an efficient stock management system that reduces the risks of overstocking or running out of inventory. If SKUs are the same in Amazon and in QuickBooks Online, they’ll be automatically recognized as one. If they are different, you can optimize the workflow with the help of the product mapping feature.

Multicurrency management

Synder creates records based on the transactions’ original currency in your QuickBooks Online account and converts them to your home currency with the rate taken from Amazon or another payment platform through which the transactions were made. The converted amounts are recorded directly in the QuickBooks multicurrency wallet in the currency you’ve chosen in your settings.

Sync rollback

You can undo the syncs when, for any reason, you’re not satisfied with the results in your QuickBooks Online account. No damage will be caused to your accounting data when the rollbock is done. After the Amazon record is deleted, you can adjust the configurations or apply an automated categorization rule and then resync the accurate data back into your books. The rollback may be done in two ways: per transaction or in bulk.

Note: Rollback doesn’t reinstate the number of syncs available.

Wrapping up

In conclusion, the Amazon and QuickBooks Online connection, when enhanced by Synder’s functionalities, can transform the way ecommerce businesses approach accounting. It’s not just about making tasks simpler, but also about providing businesses with the tools to make smarter, more informed decisions in an ever-evolving digital marketplace.

Amazon QuickBooks integration FAQ

Can I categorize my Amazon fees?

Yes. You can do this with the help of Automated Categorization feature. Here’s a step-by-step guide on how to create the rule for this particular case:

Why do my payouts have pending status?

Amazon payouts can be synced into your accounting software 14 days after they were imported to Synder (it’s due to the API restriction). During this time, the payouts will have the “Pending” status in Synder Sync and then they’ll be synced in QuickBooks Online automatically.

Is it possible to get an instant low-stock alert?

Synder can do that. To enable this action, you’ll need to utilize the Automated Categorization feature. The rule you’ll create will monitor the quantity on hand for your products in the QuickBooks Online account and notify you via email once the levels are below your specified inventory threshold.

Two options are available:

Option 1

Go to Categorization Rules → Rules → Create Rule → (choosing the trigger) Sales Receipt: Created → (choosing the condition) IF: Line Product or Service → less (enter the amount you need) → Yes → (choosing the action) THEN: Email → Inventory for [product name] went down → [Product name] went down. Please, repurchase.

This will tell Synder that an email should be sent to the company owner with any text you specify in your condition.

Note: The Rule will be activated once a sales receipt is created.

Option 2

You can use a Synder template and edit it so it suits your needs.

Go to Categorization Rules → Templates → Inventory → Alert inventory goes down in Sales Receipt → Try it out.

Check out a detailed Synder guide to learn more – How To Get Instant Low Stock Alerts.

Can I add more platforms to Synder?

Yes. In addition to an Amazon account, you can also connect other ecommerce platforms, such as eBay, Shopify, Etsy, etc, to Synder. Keep in mind that it’s recommended to connect both ecommerce platforms and payment gateways so Synder Sync is able to recognize all transactions and record them into your QuickBooks Online account.